Non-banking institutions’ dividend capped at 30pc

The central bank yesterday imposed a dividend cap of 30 % on non-bank finance institutions (NBFIs).

Of the amount, the NBFIs must pay 15 per cent in the stock dividend, and the others will be paid in the type of cash.

On February 24, the Bangladesh Lender had barred the NBFIs from paying a lot more than 15 per cent in income dividend. It explained nothing about the stock dividend.

However, many of the NBFIs, together with the Bangladesh Merchant Bankers Association, repeatedly requested that the central bank reconsider the decision to allow the payment greater than 15 % dividend.

"They misinterpreted the problem, alleging that the guidelines of giving 15 % cash dividend have previously put an adverse impact on the capital market," said a central bank official.

The BB asked a number of the NBFIs in the first week of February never to declare dividends in excess, given the ongoing slowdown running a business.

Still, a number of the NBFIs announced excessive funds dividend, ignoring the regulatory instruction.

The central bank has issued the notice with the revision to get a finish to all misinterpretations.

This is the first time recently that the BB gave a directive to the NBFIs to be mindful in providing dividends, given the vulnerable financial health of some lenders.

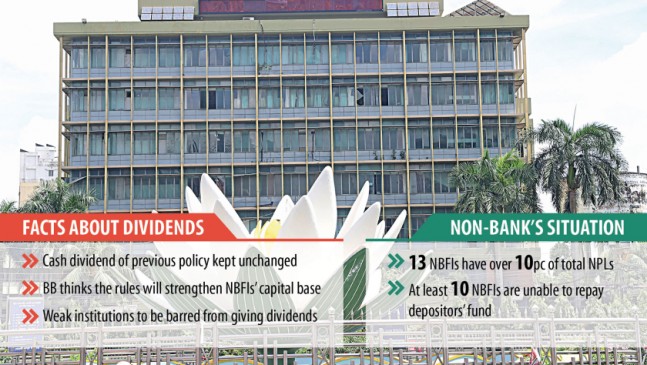

A great number of NBFIs face a capital shortage and high amounts of classified loans as a result of a wide range of scams.

According to the central bank plan, the NBFIs, which have a good capital adequacy ratio (CAR) of significantly less than 10 % and default loans of more than 10 per cent, will never be able to declare any dividend.

The central bank said the NBFIs whose default loans went past a lot more than 10 per cent would have to get approval to announce dividends.

Bangladesh features 36 NBFIs, and at least 10 of them struggle to pay back depositors money in spite of those reaching maturity.

As of December 2020, the automobile of six of the NBFIs was significantly less than what was necessary to be maintained, which is 10 %. A total of 13 experienced default loans of more than 10 per cent.

The CAR is a ratio of capital of a lender as percentage of its risk-weighted assets and current liabilities. Regulators repair the CAR to protect depositors' money.

Industry insiders express following the BB order, lots of the NBFIs would not be permitted to declare either cash or stock dividend for their shareholders for the entire year that ended on December 31 due to their ratio of classified loans was first high.