Uncertainty may possibly curb rising card spending

Spending through credit cards maintained an upward pattern in Bangladesh in January, but bankers say the growing coronavirus attacks and deepening uncertainty might discourage credit-based purchases.

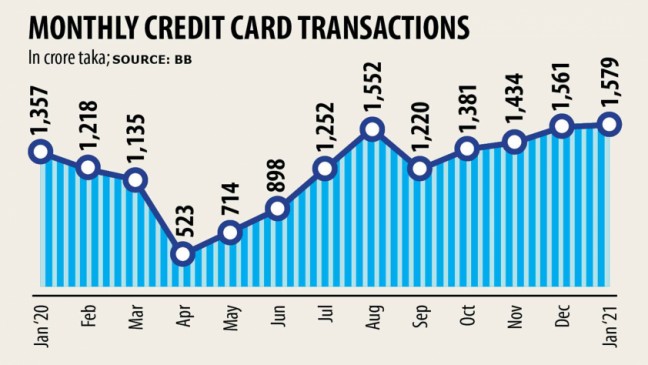

Total card loans stood at Tk 1,579 crore on January, the best on record within a month.

The figure is up 1.19 % from per month earlier and 16.38 % year-on-year, in line with the latest Bangladesh Bank data.

The upward trend may hit a higher though as a result of the rising number of coronavirus infections.

Banks took initiatives to encourage people to spend even more online on the occasion of both biggest shopping seasons: Pahela Baishakh, the first working day of the Bengali calendar, and the Eid-ul-Fitr, the biggest spending season in Bangladesh.

During the fasting month and Eid festivals, clients usually use credit cards two to three instances higher than in other months.

The transaction may face a blow this time as witnessed during the same period this past year as spending fell owing to uncertainty at the height of the pandemic in the country.

Bankers overseeing cards state if coronavirus infections continue to rise in the times ahead at the current alarming rate, persons may rein in their expenses.

Bangladesh recorded the highest quantity of deaths from Covid-19 in one day since December 15 in the 24 hours to 8:00am yesterday. Thirty-nine persons died during the period, in line with the Directorate General of Health Offerings.

At least 3,674 latest cases were recorded. The number of caseloads remained a lot more than 3,500 for the fifth consecutive yesterday because of people's reluctance to maintain health and wellbeing protocols amid lax legal enforcement.

Just after the federal government enforced a nationwide lockdown and general holiday break by the finish of March last yr, the utilization of credit cards drastically went down amid uncertainty and massive income and job losses.

It rebounded in October as the economy began to recover from the fallouts of the pandemic-induced lockdown. An archive Tk 1,561 crore was spent through bank cards in December.

The central bank is yet to get ready the credit card financing statement for February, but spending also went up in February, bankers said.

The increased use of bank cards has created hope among card-issuing banks and non-bank finance institutions that the upcoming festivals will bolster digital transactions.

"If the most recent spike of the situations continues, the card issuers will face woes," stated Ahsan Ullah Chowdhury, brain of card and digital banking in Eastern Bank Ltd (EBL).

EBL has up to now issued practically 1.70 lakh bank cards.

"People usually buy a huge number of groceries during Ramadan. Such a tendency will take popular if the deadly flu spreads more," Chowdhury said.

Mahiul Islam, head of retail banking at Brac Bank, said lenders were still sense comfort because of a hefty go back from the card businesses lately.

Transactions through bank cards during Ramadan rises nearly 3 x compared to the average month, he said.

"But this will never be likely if infections spread even more. We will work on the forthcoming festivals to improve transactions."

Brac Bank now issues 6,000 to 7,000 bank cards per month, which is greater than before.

Banks usually make discounts available to clients if indeed they purchase selected merchandise and services through the use of credit cards during festivals.

The quantity of digital transactions has been growing steadily since 2010, powered by the increasing popularity of cellular financial services (MFS).

But, digital transactions, including those routed through MFS operators, are less than 5 per cent of most retail transactions in Bangladesh.

Syed Mohammad Kamal, country supervisor of MasterCard Bangladesh, explained that card transactions would face trouble in case of a rise in infections.

However the gravity of the impact may not be dreadful compared to what the united states had gone through through the lockdown from the the other day of March to May this past year.

A good number of people have grown to be habituated with using credit cards to safeguard themselves from the virus.

"So, e-commerce will be increasing in the times to come," he said.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said the amounts of transactions would rise if infections grab as people would prefer cashless settlement to avoid dirty notes and going beyond their homes.

But the level of transactions might dip as cardholders could use less amid all of the uncertainty.

"The income level of folks has already gone down as a result of pandemic and will decline further more if the rogue virus spreads further more," Rahman said.

The issuance of bank cards rose in January, when the number of cards stood at 16.93 lakh, up from 16.76 lakh a month ago.