DSEX depressed despite soaring profits of firms

The DSEX, the benchmark index of the Dhaka Stock Exchange, is refusing to pick up even though the profits of the listed companies continued to soar in the last five years.

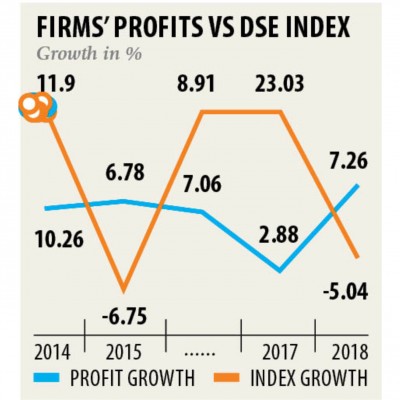

Overall, the listed companies logged a profit of Tk 21,457 crore in 2013 and it soared 10.26 percent the following year, according to data from the DSE.

In the successive three years their profits rose 6.78 percent, 7.06 percent and 2.88 percent respectively. In 2018, their profits amounted to Tk 29,847 crore.

And yet, the market remains bearish most of the time, fanning frustration among investors.

For instance, on Monday, the DSEX plunged to 4,711, a three-year low.

“Maybe, the stock investors are skeptical of the earnings reported by the listed companies, so the index did not rise,” said Mohammad Musa, a stock market analyst.

Investors have a negative perception of the market, so the key index is not picking up, he said.

Though the profit of the listed companies is rising, the DSEX hovered around 4,900 to 5,400 points for the best part of the last five years. The index was buoyant for about three months towards the end of 2017 when it hit 6,336 points.

Some bad news of default loans and scams in banks and non-bank financial institutions dented investors’ confidence, so the stocks plummeted and the index was negatively influenced even though the profit of the two sectors is rising, said Musa, a former dean of the school of business and economics of the United International University.

Though the listed companies’ earnings rose, many companies provided stock dividend and right shares during the period.

“This caused the fall of the share prices too,” Musa added.

Bangladesh’s stock market is retail investor-driven and they invest mostly for capital gains without any careful analysis, said a stock broker requesting anonymity.

“So, the index does not depict the real scenario of the economy and listed companies’ profitability. I see a huge mismatch in many stock prices due to a lack of analysis-based investment,” said the broker, who was a former president of the DSE.

Take, for instance, the case of Monno Jute Stafflers, whose price is now more than Tk 1,500 even though its price-to-earnings ratio is upwards of 200.

“Yet, more investors rushed to have the stock, whereas many well-performing stocks are declining but they have no interest on them,” the broker said.

Investors flocking towards Stylecraft, National Tubes, Monno Ceramics, Legacy Footwear and many other poorly performing stocks raised questions of the investors’ analytical ability, he said.

Such mismatch is frequent in the market, so the index is declining even after the listed companies’ earnings are rising.