Foreign fund in DSE keeps falling

The net foreign investment on the Dhaka bourse has kept falling for the seventh straight month because of eroding investor confidence and the rising fear of depreciation of the local currency.

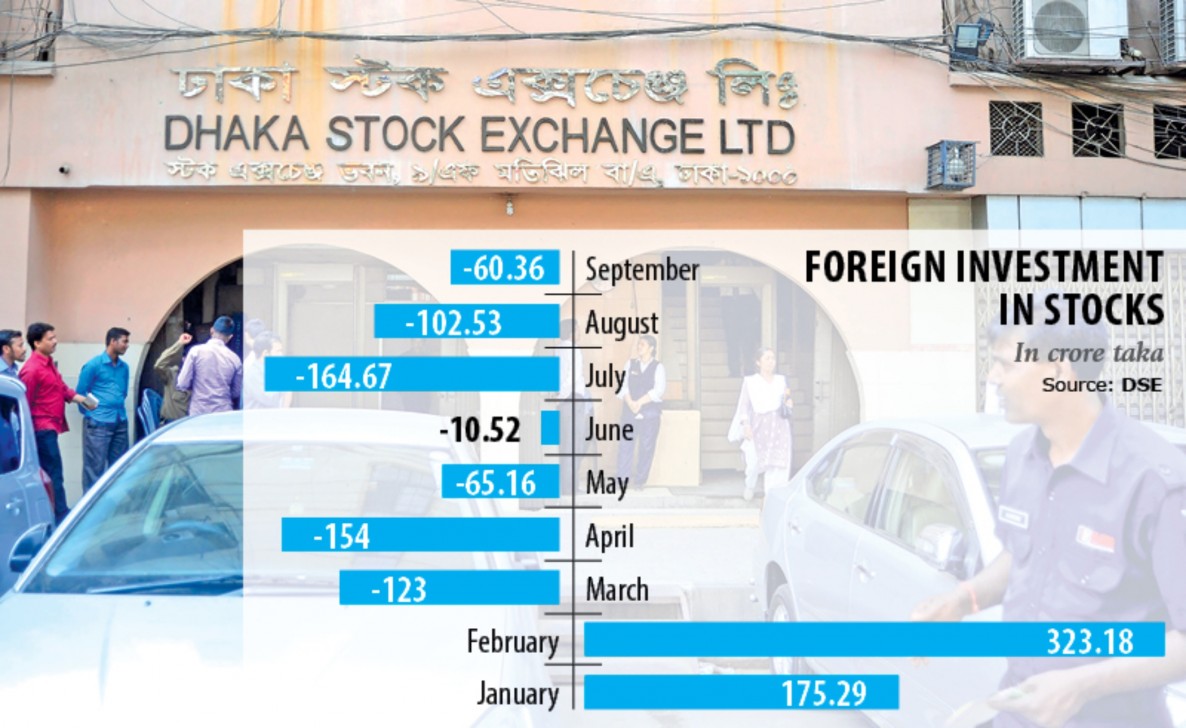

Their net investment hit Tk 60.36 crore in the negative in September, when foreigners bought shares worth Tk 257.78 crore and sold securities amounting to Tk 318.14 crore, according to data of the Dhaka Stock Exchange (DSE).

It was Tk 102.53 crore in the negative in August.

A stock broker, who deals with a large number of foreign portfolio accounts, said foreign investors are suffering from confidence crisis, largely because of the government’s tough stance against Grameenphone.

The foreign investors were upset with the government’s declaration of Grameenphone—one of their prime choices—as a significant market player in February, which is expected to the affect the telecom operator’s earnings.

Following the move, the net foreign investment plunged to Tk 123 crore in the negative in March, reversing from Tk 323 crore in the positive a month ago. The portfolio investment has been falling since then.

“The number of well-performing stocks in the market is too low to make huge investment. Moreover, the government takes decisions whimsically about a company any time. So, it is risky to park huge level of investment in the country,” the stock broker quoted a foreign investor as saying.

The High Court has, however, stayed the move of Bangladesh Telecommunication Regulatory Commission on GP, but foreign investors are not still upbeat.

Another stock broker said the government lacks policy consistency on tax measures that affect listed companies or takes initiatives that may hamper earnings of companies.

British American Tobacco Bangladesh (BATBC) is one such example.

Md Azizur Rahman, company secretary of BATBC, told The Daily Star last month that the company’s earnings fell due to a slump in sales in the low-segment tobacco products, which saw an increase in tax.

The company’s earnings per share plunged 43 percent year-on-year to Tk 9.73 in the April-June quarter of 2019.

Foreign investors are also fearing that the local currency may depreciate to a large extent in future as the current account balance deficit and trade deficit continue to pose risks to macroeconomic stability, according to market insiders.

So, the investors prefer to book profit before any further devaluation, they added.

According to the central bank data, trade deficit more than doubled to $15.94 billion in 2018-19 compared to 2015-16.

The current account balance deficit was also at a sizable amount at $5.25 billion in the last fiscal year.

Economists says if the deficit continues to widen, it will put pressure on the local currency. Already, it has depreciated.

Yesterday, a USD traded at Tk 84.50, up from Tk 83.78 a year earlier.