BB move boosts stocks

Stocks jumped up yesterday buoyed by a Bangladesh Bank move that allowed banks to invest in equities by borrowing funds from the banking regulator.

On Sunday, the BB announced a liquidity support for banks with a view to ramping up their capacity to invest in the market as part of a concerted effort to arrest the ongoing bear run.

The liquidity support will be provided in the form of Repurchase Agreement (repo), a form of short-term borrowing by banks from the central bank by placing government securities as collateral.

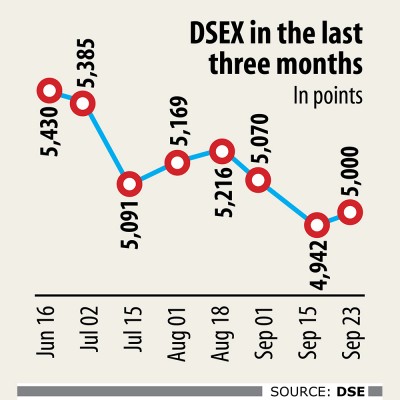

The impact of the BB move was immediate: Yesterday, the DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), climbed 79.26 points, or 1.61 percent, to end the day at 5,000.23.

This is the highest single day rise of the index in the last five months, helping the key index go past the psychological 5,000-mark.

The BB move aims at making the lenders—which have scope to invest in securities but are constrained by liquidity crunch—active in the stockmarket.

“It is a welcoming initiative which boosted investors’ confidence,” said Rakibur Rahman, one of the directors of the DSE. The government will have to continue providing the support to the market to keep it alive, said Rahman, also the chairman of Midway Securities.

The central bank measure came after it realised the impact of the liquidity crunch on the market slump in the last few months. The broader index lost around 10 percent in the last three months. The index regained 145.23 points in the last two days.

Earlier this month, the central bank increased the advance-to-deposit ratio to 85 percent for banks from 83.5 percent in a bid to mitigate the liquidity crunch.

Yesterday, the top three positive index contributors of the market were Brac Bank, British American Tobacco Bangladesh and Renata.

Of the traded stocks, 282 gained, 53 dropped and 18 remained unchanged.

Among the major sectors, non-bank financial institutions exhibited the highest positive movements with a 3.58 percent gain, while fuel and power showed negative movement, shedding 0.12 percent.

Turnover, another important indicator of the market, rose 70 percent to Tk 517.34 crore yesterday compared to the previous day.

Prime Finance topped the gainers’ list with a rise of 9.72 percent, followed by Sonar Bangla Insurance, Meghna Condensed Milk, International Leasing, and Provati Insurance.

On the other hand, the worst loser was National Polymer, which gave up 9.93 percent. Grameenphone became the top-traded stock with a turnover of Tk 20.17 crore worth of shares, followed by National Tubes, Summit Power, VFS Thread Dyeing, and Fortune Shoes.

Chattogram stocks also rose with the bourse’s benchmark index, CSCX, advancing 164.95 points, or 1.81 percent, to finish the day at 9,241.72.

Gainers beat losers as 199 securities advanced, 36 declined and 18 finished unchanged on the port city bourse.