Banks hardly lend via agent banking

Banks are showing reluctance in lending through the agent banking window based in rural areas despite mobilising large sums through the platform.

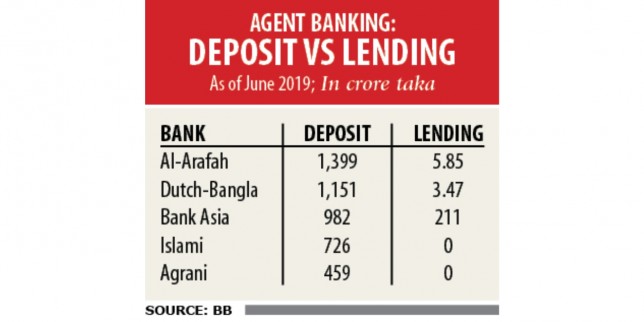

As of June, Tk 5,284 crore was collected through the window, up from Tk 2,013 crore a year earlier, according to data from the Bangladesh Bank.

But only Tk 237 crore was lent through the window, up 72 percent year-on-year.

“The year-on-year lending growth was apparently good last quarter, but it hardly had any impact on rural entrepreneurs because the amount is little,” said a Bangladesh Bank official.

The trend of deposit mobilisation and lending indicates banks are more interested in collecting funds from rural areas than extending lending facilities to them.

“This has created an imbalanced situation between the urban and rural areas. Banks are mopping up money from rural areas and giving out loans in urban areas,” the central banker said.

Against the backdrop, the central bank has repeatedly urged the banks that were the first to roll out agent banking to scale up their lending through the channel. But the banks did not pay any heed to the instruction.

Curiously, one bank that has mobilised the most deposits through the window has lobbied with the central bank to bar banks from disbursing loans by way of agents, the BB official added.

But the central bank has rejected the plea and directed it to accelerate lending, he said.

Md Anwarul Islam, a general manager of BB, said they are asking banks to increase loan disbursement through agents.

Nineteen banks have so far commenced agent banking services, but only seven give out loans.

With a view to taking banking services to the underserved parts of the country, the BB in 2013 issued the agent banking guideline. But the licensees did not start full-fledged operations until 2016. Agent banking offers limited banking and financial services by way of village stores.

Agents provide services such as cash deposits, withdrawals, remittance disbursement, small value loan disbursement and recovery of loans as well as cash payments under the government’s social safety net programmes.

Of the total disbursed loans, Bank Asia accounts for 89 percent of the sum and has plans to bump up its lending even more. Md Arfan Ali, managing director of Bank Asia, said his bank was now focused on accelerating loan disbursement through the agent banking window.

“The bank wants to disburse loans at the same rate at which it mobilises deposits from rural areas.”

The reason being, Bank Asia is working to lessen its loan concentration by way of giving out small loans to a wide range of customers, he said.

Through the window, Bank Asia, one of the pioneers in agent banking, disburses loans ranging from Tk 20,000 to Tk 20 lakh. In some cases, it disbursed even Tk 50 lakh to a single client, he said.