Banks’ capital base strengthens

The banking sector’s capital base strengthened on paper in the second quarter of the year after some banks were allowed to keep their provisioning against default loans in phases.

Besides, some lenders also recovered a good amount of fund from defaulted loans, which has made their capital base stronger than a quarter earlier.

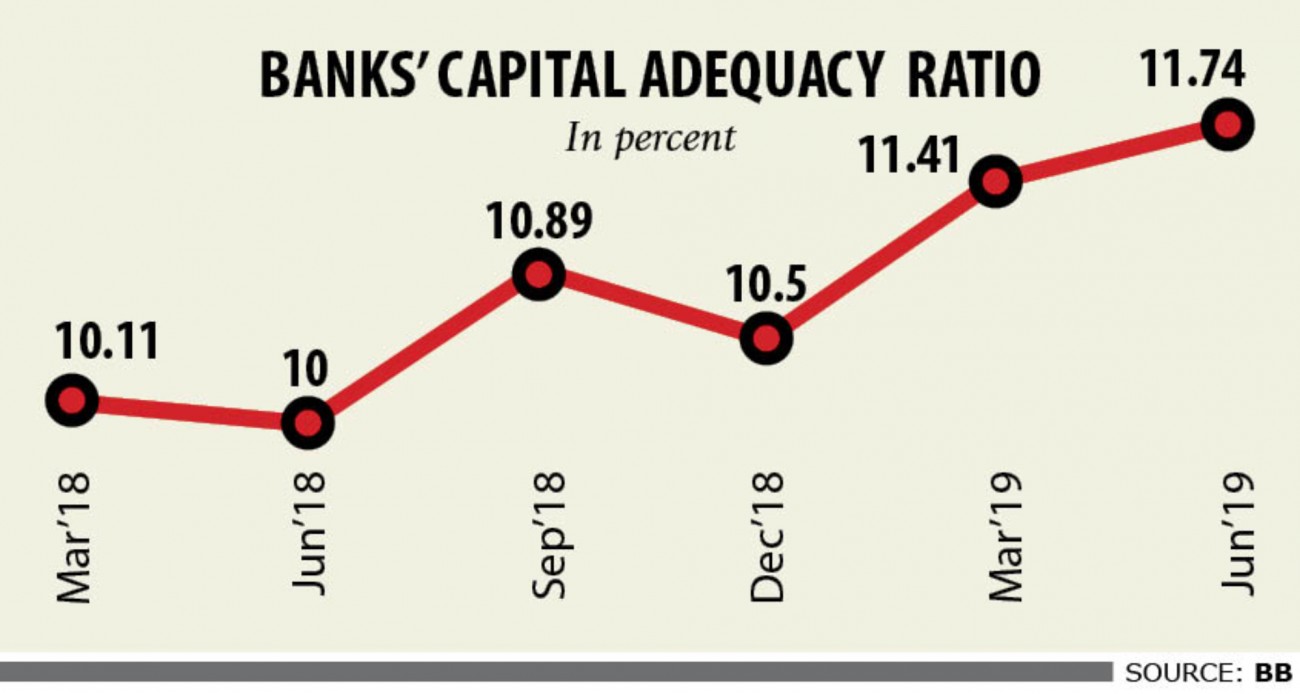

As of June this year, banks’ capital adequacy ratio (CAR), which determines the adequacy of banks’ capital in keeping with their risk exposure, stood at 11.74 percent, up from 11.41 percent three months earlier and 10.11 percent a year earlier, according to data from the central bank.

But the country’s banking sector has failed to maintain CAR as per the roadmap set by the central bank for implementation of Basel III this year, said a central bank official with strong knowledge on the matter.

From the first quarter of the year, banks were asked to maintain CAR at 12.50 percent in line with the global best practices.

But the banking sector has failed to achieve the global benchmark for CAR thanks to 11 banks, including seven state-owned lenders.

The banks are: Sonali, Janata, Agrani, Rupali, Basic, Bangladesh Krishi, Rajshahi Krishi Unnayan, AB, Bangladesh Commerce, ICB Islamic and National Bank of Pakistan.

They collectively faced a capital shortfall of Tk 16,001.49 crore.

“These banks will face trouble in conducting business with foreign banks in the days ahead unless they increase their CAR,” the BB official said.

CAR has to be maintained to safeguard the interests of depositors and promote financial stability. As of June, Janata’s capital shortfall is Tk 1,201.15 crore, down from Tk 4,888 crore three months earlier.

Janata’s provisioning shortfall hit Tk 8,256 crore, the highest yet for a bank in Bangladesh’s history.

But the state lender later got a deferral support from the central bank to keep provisioning in phases between 2019 and 2022, which has decreased the capital shortfall significantly on paper.

Agrani’s capital shortfall was Tk 456 crore at the end of June, down from Tk 1,054 crore three months earlier.

The bank recovered Tk 1,350 crore from default loans in the first six months of the year. Last year, it managed recovery of about Tk 1,000 crore, said its managing director, Mohammad Shams-Ul Islam.

Capital shortfall of the other five state lenders escalated in the second quarter though.

The rising CAR is a good indication of the state of the country’s banking sector, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks’ chief executive officers.

“But we have yet to reach the CAR set by Basel III. We should give our best effort to improve CAR further.”

Full-fledged implementation of Basel III is highly important for banks to run global business smoothly, said Rahman, also the managing director of Dhaka Bank.