Listed cement makers’ earnings on the decline

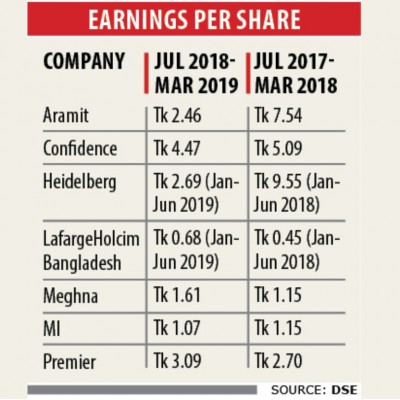

Out of the seven cement manufacturers listed on the Dhaka Stock Exchange (DSE), earnings per share of three companies rose in recent quarters while the rest witnessed a decline.

Small investors, however, complained that the listed cement companies are not paying good dividend using excuse of lower profits or losses. According to DSE data, the EPS of Aramit Cement dropped to Tk 2.46 in the three quarters of the last fiscal year (from July 2018 to March 2019), down from Tk 7.54 year-on-year.

The EPS of Confidence Cement fell to Tk 4.47 during the same period from Tk 5.09.

Heidelberg Cement Bangladesh Ltd, a foreign firm, saw a decline for two quarters from January through June this year and MI Cement Factory, which produces Crown brand cement, witnessed a declining trend from July 2018 to March 2019.

The earnings of Premier Cement, Meghna Cement and LafargeHolcim Bangladesh are on the rise, DSE data showed.

The EPS is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability. The higher a company’s EPS, the more profitable it is considered.

“Unhealthy competition among the manufacturers and excess production than demand are shrinking profit margin,” said Alamgir Kabir, managing director of Crown Cement, and also the president of Bangladesh Cement Manufacturers Association (BCMA). According to the BCMA, the sector has grown 12 percent on an average in the last eight years.

At present, 42 cement factories are active, with a combined installed manufacturing capacity of 5.5 crore tonnes per year. The annual demand is 3.5 crore tonnes.

The market size of the sector is Tk 13,000 crore. Manufacturers have invested Tk 30,000 crore in the sector. Of the total consumption, individuals account for 25 percent, real estate and developers 30 percent, and the government 45 percent.

Cement-makers are facing challenges to make profits due to intense competition despite increasing consumption, particularly by the government, manufactures said.

Kabir said it would take at least four years to get rid of the unhealthy competition as demand will increase.

Zahir Uddin Ahmed, managing director of Confidence Cement, said the company’s profit margin is declining continuously owing to the competition and the rising production and transport cost.

He said a move was taken to raise the retail price by Tk 40 per 50-kg bag recently but it did not materialise.

Mohammed Amirul Haque, managing director of Premier Cement, said the listed company has to bear additional operating cost that reduces the margin of profit.

“We are competing with private limited companies and our operating cost is higher than the non-listed ones,” he said.

Haque fears the profit margin would decline in the future as the cost of production is increasing because of the introduction of advance income tax which is not adjustable.

He said Premier Cement had announced good dividend when it posted good profit.