Stocks slump for fifth day

The stock market continued to bleed for the fifth day straight as tension surrounding the regulatory tussles of Grameenphone, the largest company on the Dhaka Stock Exchange, refuses to calm down, affecting the overall mood of the market.

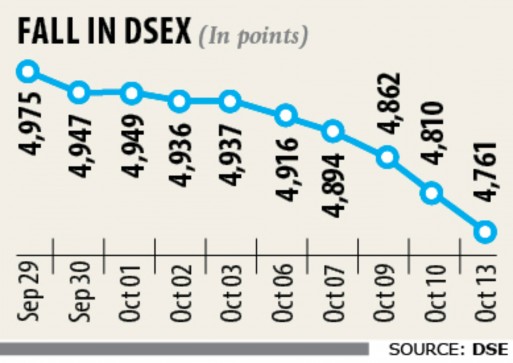

In the last five days, DSEX, the benchmark index of the DSE, lost 175.95 points and Tk 13,031 crore in market capitalisation.

Yesterday, the index lost 48.34 points, or 1 percent, to close at 4,761.87 -- the lowest in three years.

A stock broker upon condition of anonymity said Grameenphone’s tug-of-war with the telecom regulator over unpaid dues is a major reason for the slide.

The Bangladesh Telecommunication Regulatory Commission has demanded Tk 12,579.95 crore from Grameenphone in unpaid dues after audit into its books since its inception. But the carrier disputes the amount.

The country’s leading mobile operator’s stock took a huge beating since February because of the issue. Since then, Grameenphone shares slumped 21.31 percent.

However, investors saw a light at the end of the tunnel when Finance Minister AHM Mustafa Kamal stepped in on September 17 and announced the matter would be resolved within three weeks.

“But, the tension is still prevailing as the issue remains unsettled. So Grameenphone stock fell in the last few days,” the stock broker added.

Grameenphone stocks fell 2.1 percent yesterday to Tk 326. With this fall the index lost about 17 points alone yesterday.

The government’s tough decision on the largest listed company impacted the confidence of foreign and institutional investors, said another stock broker.

Moreover, the stock market regulator failed to curb the manipulation on many stocks in recent months, he said, adding that the general investors lost money and big investors lost confidence.

“So, institutional investors are not investing money even after the Bangladesh Bank offered loans to banks to invest in stocks,” he added.

Last month, with a view to boosting the ailing stock market the central bank widened the scope for banks to invest in the stock market by offering loans through repo.

A merchant banker said investor confidence was hit by the liquidation of People’s Leasing too.

On the other hand, the government announced some other non-bank financial institutions are also on the verge of liquidation.

A top official of the Bangladesh Securities and Exchange Commission (BSEC) said they can provide policy support but cannot force people or institutions to invest in stocks.

“In the last few months we have provided many policy support along with the central bank. Even after that, stocks are falling. What can we do now?”

Yesterday, turnover, another important indicator of the DSE, plunged 9.03 percent to Tk 298.19 crore.

National Tubes topped the turnover chart with its transaction of Tk 25.23 crore, followed by Wata Chemicals, Bangladesh Submarine Cable, Monno Jute Stafflers and Bangladesh Shipping Corporation.

Of the traded issues, 41 advanced, 267 dropped and 37 remained the same.

Chittagong stocks also fell, with the bourse’s benchmark index, CSCX, declining 86.13 points, or 0.96 percent, to finish the day at 8,814.43.

Losers beat gainers as 181 declined and 30 advanced, while 25 finished unchanged on the Chittagong Stock Exchange. The port city bourse traded shares and mutual fund units worth Tk 14.33 crore.