Credit growth plunges to 12-year low

As more and more economic data trickle in of the past few months, we are getting a more accurate barometer of the sweeping pall of pessimism that has enshrouded the economy.

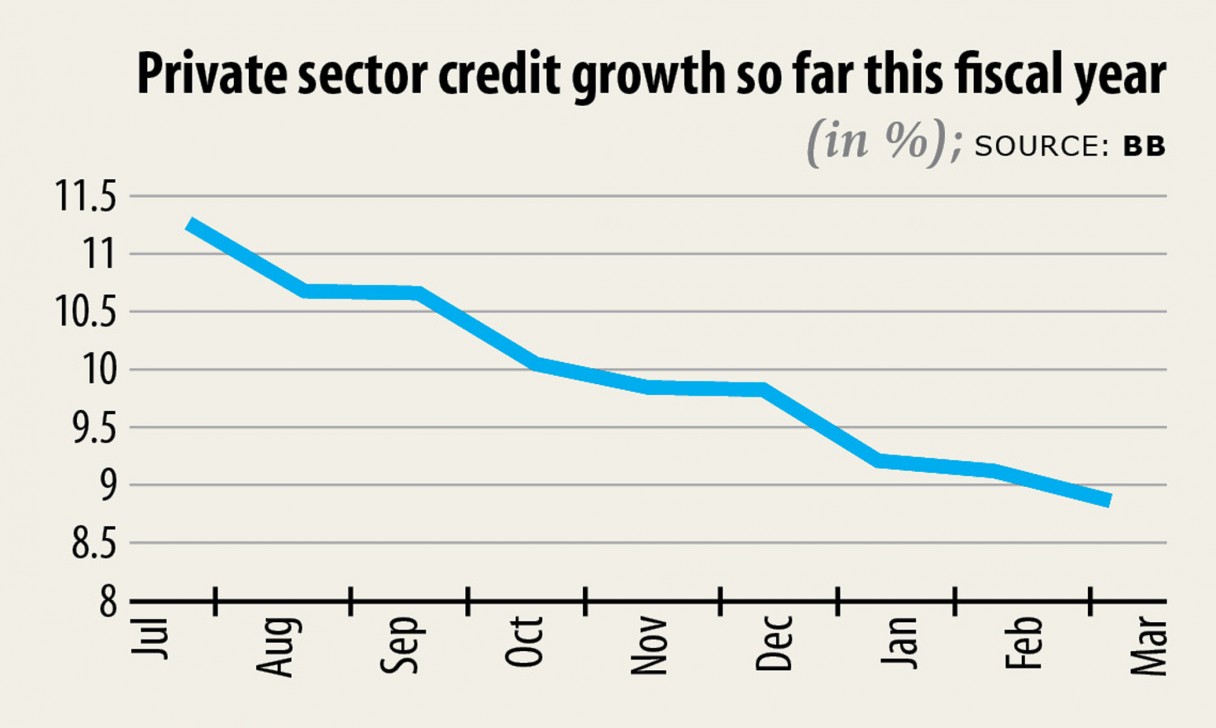

Take the case of private sector credit growth, which nosedived to 8.86 per cent in March, the lowest since December 2008, indicating the businesses' overly glum outlook.

The first confirmed cases of COVID-19 in Bangladesh were announced on March 8 and 22 days later the government enforced a stay-at-home order to flatten the curve on the rogue virus that has upended lives and livelihoods like no other.

The credit growth had been maintaining a downward trend for the last two years but the fall in March was relatively steeper compared with the previous months.

March's figure is also lower than the 9.13 per cent reported in February.

Credit flow to the private sector stood at Tk 10,66,474 crore as of March, according to data from the Bangladesh Bank.

Private sector credit growth is supposed to have declined in April and May to a large extent as most economic activities were on pause until May 30, said a central bank official.

Operations of all factories, industries and services across the country were largely suspended during the time.

The Bangladesh Bank will disclose the credit growth figure for April within a day or two.

"There is no demand for fresh investment at this moment as both the local and global economies are going through a tough situation," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

And this was reflected in the private sector credit growth in March.

The falling trend in the credit growth could be slowed once businesses begin to receive funds smoothly from the stimulus funds unveiled by the central bank, he said.

"But the economy will not rebound unless people become confident about the government's initiatives to improve the health sector."

E-commerce and businesses that produce medical products like mask, personal protective equipment and hygiene items will get a boost during the pandemic.

The enterprises making these products should be extended all types of cooperation, including financial support, as it will make the economy vibrant to a certain level, Hussain added.

"There is no possibility that the private sector credit growth would accelerate until the world gets a vaccine to fight against the coronavirus," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Contraction of private sector credit growth means unemployment would rise alarmingly and the country would have to face the consequence in the days ahead.

Besides, the private sector has been facing various problems for a long time and this has been reflected in the credit growth, said Mansur, also a former official of the International Monetary Fund.

Government borrowing from the banking sector has been growing since the beginning of the fiscal year, which can potentially crowd out private sector investment.

The government should avoid borrowing from scheduled banks as this would harm the private sector, he said.

Both the central bank and the government should start working on mitigating problems so that the private sector can make a turnaround in the quickest possible in keeping with a global recovery.

The government will have to take initiatives to improve the country's ranking in the index of the ease of doing business and to iron out bureaucratic tangles in the interest of the private sector.

"This will help the economy recover at a faster pace," Mansur added.