Benefits yet to reach investors

Frequent gambling, shaky confidence, lower turnover and lack of well-performing companies and new products continue to dog the stock exchanges five years past their demutualisation.

On November 22, 2013, Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) were demutualised, a process that transformed the bourses from non-profit cooperatives into for-profit companies owned by shareholders.

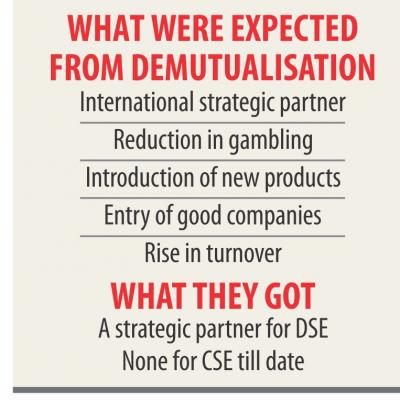

The main goal of the demutualisation was to reduce the impact on the stock brokers, who were the bourses' owners then, in the exchanges' activities with the view to checking gambling tendencies.

The process also separated the bourses' ownership from the management, which was expected to bring back confidence in the market after the crash of 2011.

The other aim of demutualisation was to make the bourses profitable, so that they worked hard to bring new products to the market and try to gather more investment.

But, the stock exchanges are still suffering for want of new products, leaving the DSE to mostly depend on interest income of its fixed deposits. For instance, in fiscal 2016-17 the DSE's total revenue stood at Tk 208.24 crore, of which Tk 90.48 crore, or 48 percent, came from interest income.

The only positive development was that the DSE succeeded in getting an international strategic partner, a consortium of Shenzhen Stock Exchange and Shanghai Stock Exchange, on May 14.

The CSE is still trying hard to find a strategic partner. “Stockbrokers' influence declined surely, but still they have considerable influence,” said a board member of an exchange, preferring anonymity.

Other than failing to bring any new products to the market, the bourses could not attract companies with solid fundamentals, said Abu Ahmed, a stock market analyst.

Foreign investors had found confidence to invest in the market soon after demutualisation, but they will leave soon if the frequent speculative market movement continues.

“The stock exchanges have not taken any big steps against the gamblers yet, so the confidence of investors remains low. This is the main failure of the bourses,” said Ahmed, also the former chairman of the University of Dhaka's economics department.

KAM Majedur Rahman, managing director of the DSE, said they were working hard to curb the gambling.

“If we find any suspicious transaction or movement in any stock, we inform the regulator immediately.”

The DSE is ready to introduce new products but the process is getting delayed due to the lack of coordination among regulators.

“We succeeded in rolling out a mobile app so that investors can trade stocks from their mobile phones,” he added.

At present, 39,000 use the mobile app, which was introduced on March 9, 2016, to buy or sell stocks.

CSE Managing Director M Shaifur Rahman Mazumdar said they were working with an Indian exchange about possible strategic partnerships.

“We can't bring any new product outside the rules and regulations of the Bangladesh Securities and Exchange Commission. So, the BSEC will have to shoulder some blame. Whenever they initiate the rules, we will bring the new products.”