Stocks feeling the election nerves

Stock market investors are feeling jittery ahead of the national election scheduled for December, a worrying development.

Even last month's disclosure of record GDP growth in fiscal 2017-18, higher government spending, the entry of a Chinese consortium into the Dhaka Stock Exchange and the easing up of liquidity crisis have all failed to jumpstart the market, which has been sluggish since the turn of the year.

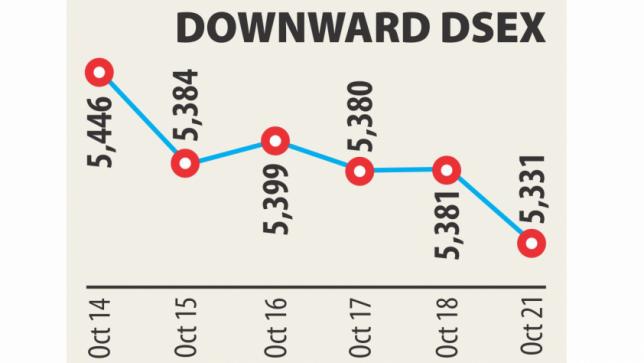

The DSEX, the key index of the DSE, tumbled over 50 points yesterday to close at 5,331. Turnover stood at Tk 439 crore, down 7.7 percent from the previous day and about 50 percent from a month ago.

Investors lost nearly Tk 3,500 crore yesterday and Tk 6,545 crore in the last five days.

“Election sentiments are in the minds of investors and many of them have taken a cautious stance,” said a market analyst.

The market is facing a lack of buyers, prompting it to drop by nearly one percentage point yesterday, he said.

Another analyst said only the Investment Corporation of Bangladesh, a state-owned entity, can help stabilise the market.

“But ICB is in a tight position as it is yet to get the funds from selling a bond worth Tk 2,000 crore,” said the head of a bank's securities wing.

The central bank two weeks ago cleared the way for ICB to issue the bond by informing banks that their investment in it will not be counted as their market exposure.

Meanwhile, IDLC Securities said yesterday's fall was driven by a decline in energy, food, engineering and textiles stocks.

KPCL, which declined 7.2 percent in value, was the most traded stock with its transaction of Tk 26.6 crore.

Losers beat gainers clearly as 259 stocks declined, 49 advanced and 35 finished unchanged on the DSE.

Three companies recommended dividends on the day: state-owned power entity DESCO announced 10 percent cash dividend, MI Cement 15 percent cash dividend, and Rahim Textile Mills 20 percent cash and 10 percent stock dividend for the year that ended on June 30, 2018.