Stay calm, no valid reason for price drop

The stock market regulator yesterday urged investors to stay composed as there is virtually no reason behind the recent drop of the key index.

The key index of the Dhaka Stock Exchange, DSEX, fell 194.45 points, or 3.57 percent, in the last seven days, bringing the index down to an almost 22-month low of 5,251.95 points.

There is no political turmoil or any chaos in the country, so it is illogical to be panicked now, said Saifur Rahman, executive director of Bangladesh Securities and Exchange Commission.

Rahman's comments came after a meeting with capital market stakeholders at the headquarters of the Investment Corporation of Bangladesh (ICB) in Dhaka to get to the bottom of the DSE's current sinking trend.

At the meeting, the stakeholders traced three reasons behind the recent drop: shrinking of foreign investment, apprehension of political turmoil and thin participation of institutional investors, said an attendant requesting anonymity.

“The election takes place every five years -- it is normal. So why have people become panicked?”

Subsequently, Rahman called for calm.

Besides, the ICB is set to invest more than Tk 1,500 crore in the market very soon.

And the Tk 947 crore that the stock brokers will get from the Chinese consortium for the 25 percent stake sell-off will also be locked in the market for the next three years, he added.

“It's true that foreign investment in our market has reduced in recent months,” said KAM Majedur Rahman, managing director of the DSE.

But it is a completely normal phenomenon ahead of an election anywhere. “There is nothing to worry,” he added.

“We did not find any logical reason behind the recent fall,” said Kazi Sanaul Hoq, managing director of ICB, after the meeting.

He went on to express hope that the market will bounce back once ICB ploughs in the proceeds of its Tk 2,000 crore-bond.

Mostaque Ahmed Sadeque, president of the DSE Brokers' Association, and Khairul Bashar Abu Taher Mohammed, secretary general of the Bangladesh Merchant Bankers' Association, were also present at the meeting.

The stakeholders also urged the BSEC to work with the Bangladesh Bank to redefine exposure limit of banks and financial institutions so that they can invest more.

Despite the reassurance, the key index of the DSE remained unchanged yesterday.

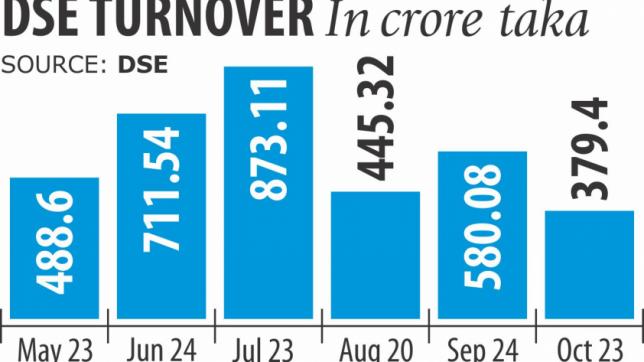

Turnover, an important indicator of the market, declined 12.80 percent to Tk 379.40 crore, which is the lowest in almost six months.

Some 10.28 crore shares and mutual fund units changed hands on the DSE.

Of the traded issues, 135 advanced, 154 declined and 53 remained unchanged on the premier bourse.

Delta Life Insurance dominated the turnover chart with its transaction of 22.04 lakh shares worth Tk 26.66 crore. It was followed by Khulna Power Generation, Summit Power Generation, Grameenphone and Dragon Sweater.

Information Services Network was the best performer with its 9.80 percent gain, while IBN SINA Pharmaceuticals was the biggest loser, shedding 13.01 percent.

Chittagong stocks also fell yesterday, with the bourse's benchmark index, CSCX, declining 26.62 points, or 0.27 percent, to finish the day at 9,773.87 points.

Losers beat gainers as 138 declined, 65 advanced and 39 finished unchanged on the Chittagong Stock Exchange. The port city bourse traded 61.58 lakh shares and mutual fund units worth Tk 18.90 crore.