Not all brokers jumping at tax waiver

Some 21 percent of the stockbrokers do not want to invest the amount they got from the Chinese consortium in the stock market, preferring instead to pay the 15 percent capital gains tax.

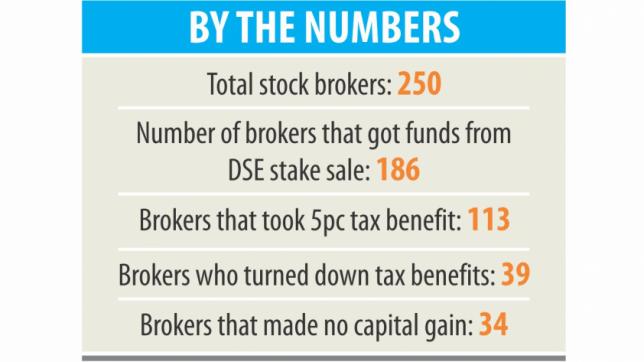

The 250 stock brokers of the Dhaka Stock Exchange got Tk 962 crore by selling 25 percent stake, or 45.09 crore shares, to the consortium of the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

Of the amount, Tk 15 crore has been deducted as stamp duty, leaving Tk 947 crore for the stock brokers.

At present, the tax on the profits made from the sell-off of an asset like stocks, bond and so on is 15 percent.

With a view to shoring up the capital market, which has been depressed since the turn of the year, the National Board of Revenue came up with the tax waiver package but with the condition that the proceeds from the sell-off be kept in the market.

If the stock brokers plough back the amount they received from the Chinese consortium into the stock market and lock it down for at least three years, the capital gains tax for them would be 5 percent.

So far, 186 of the stock brokers have received their amounts from the stake sell-off and 39 do not want to lock down their windfall in the stock market.

This means, almost Tk 140 crore of the proceeds from the stake sell-off will not come back to the market.

“It is disappointing,” said a high official of the Bangladesh Securities and Exchange Commission.

One of the brokers who paid the 15 percent capital gains tax said, on condition of anonymity, that he did not want to keep the amount in the stock market for three years as he apprehends the current bear run will prolong.

Since the turn of the year, investors lost Tk 45,813 crore. The DSEX, the benchmark index of the DSE, dropped 1,021 points since January 1. The broker said he has a plan to invest the money elsewhere, so he paid the full tax.

Another broker said the country's political situation is not looking stable, so he did not want to take a risk.

“It's a personal decision whether they take the tax waiver and pour the money into the stock market or not,” said Mostaque Ahmed Sadeque, president of the DSE Brokers Association, which lobbied the finance minister for the tax privilege.

However, he thanked the government for offering the facility as it has created an opportunity to bring in some fresh funds to the market. DSE data showed 113 brokers have received their money by paying 5 percent tax, while 34, who each received cheques of Tk 3.78 crore, paid no tax as they made no capital gain from the transaction with the Chinese consortium.

Some 64 brokers have not collected their cheques yet as they are still undecided, said a high official of the DSE.

“They are waiting on the political situation,” he added.