Withdraw advance tax on import of raw materials

Feed makers yesterday urged the government to withdraw advance tax on the import of raw materials of feed and machinery of the poultry industry, as the new fiscal measure has increased the cost of their businesses.

The industry operators said imports of products related to livestock and fish farming are exempted from customs tariff, duties and taxes. Therefore, the imports of the raw materials of feed should not be subject to advance tax (AT).

The National Board of Revenue (NBR) introduced 5 percent AT under the Value Added Tax and Supplementary Duty Act 2012 that came into effect on July 1 this year.

“There should not be any AT on raw materials of feed as there is no VAT in our sector,” Moshiur Rahman, president of the Bangladesh Poultry Industries Central Council (BPICC), said at a press conference at the National Press Club in Dhaka.

The Feed Industries Association of Bangladesh (FIAB) organised the briefing, more than a week after the NBR exempted certain raw materials of fish feed from AT.

The FIAB said the exemption has been provided only to ingredients of fish meal and the benefit does not cover all the raw materials of poultry and fish feed.

So, instead of resolving the problems, the livestock sector faces extra complexity following the issuance of the revised notification on AT, said Md Ahsanuzzaman, general secretary of the FIAB, while reading out the association’s statement at the briefing.

Rahman said AT has been exempted on items which are not used by feed millers. They raised their problems with the NBR on several occasions but they have remained unresolved.

The prices of feed would increase unless the NBR withdraws the AT, leading to spiral in prices of chicken meat and eggs, one of the key and relatively cheaper sources of protein.

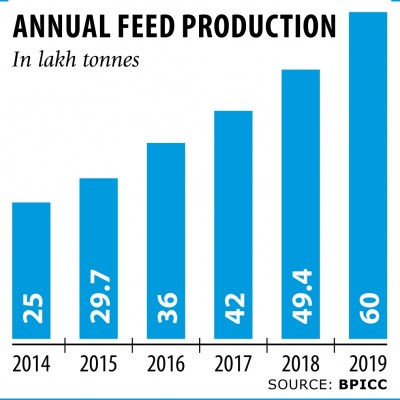

Prices of broiler feed already doubled to Tk 43.57 a kg in 2018 from Tk 21 in 2007, said the FIAB, which represents nearly 60 lakh tonnes annual feed industry in Bangladesh.

The association demanded removal of the provision of deducting tax at source on purchase of maize, rice bran and other ingredients.

The NBR levied 2- 5 percent tax at source that feed millers are supposed to deduct during payment to sellers of the ingredients and deposit them to the state coffer later.

The FIAB said maize sellers are mainly farmers and it would be a big burden for them if they face the tax deduction at source.

The association also urged the government to speed up clearance of imported consignments of feed raw materials, as importers have to wait up to 42 days to have their imported consignments released.

Clearance time should not be more than seven days, said the FIAB, adding that they have to bear additional charges for delayed clearance from the Chattogram port.

Feed makers also urged the government to allow import of vaccines of avian influenza H9N2 viruses on special consideration ahead of the coming winter.

Poultry production has fallen in recent years after it came under attacks of the flu, the association said.

Industry operators said they have been seeking permission to import the vaccines and also to produce them locally for the last two years, but the approval has not been given yet.

The outbreak of the avian influenza usually takes place in winter. So, poultry farmers and entrepreneurs are fearing a massive attack of the disease in the coming winter season, Ahsanuzzaman said. Feed production is expected to double to 60 lakh tonnes in 2019 from 29.7 lakh tonnes in 2015. The sector caters for the poultry industry, which produces 14.6 lakh tonnes of chicken meat annually, according to the BPICC.

At present, more than 200 feed mills are registered and they meet the entire local demand for feed for poultry, aquaculture, and dairy farming, the association said.