Tax receipts fall short of target by 20pc

Tax collection fell short of target by 20 percent in fiscal 2018-19, with the National Board of Revenue (NBR) blaming exemptions and discounts given to various sectors, election and state-run agencies’ reluctance to pay arrears for the slowing receipts.

Last fiscal year it collected Tk 223,892 crore against the target of Tk 280,000 crore, up 10.7 percent year-on-year, which is the lowest in six years.

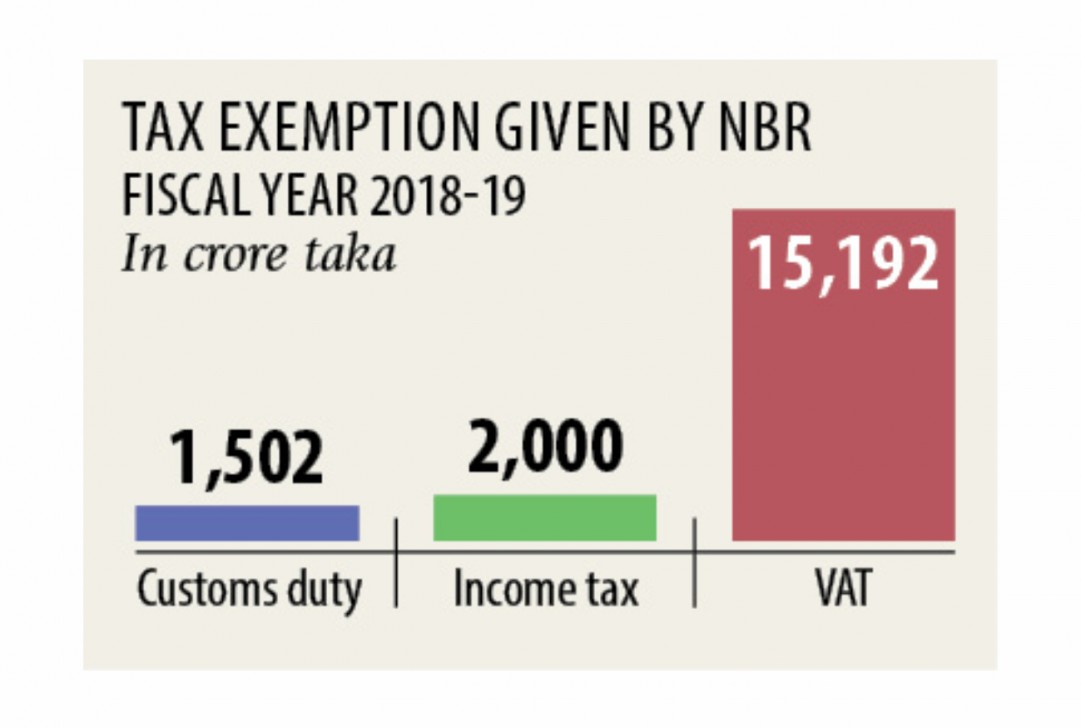

The NBR said it gave Tk 18,694 crore as exemptions and waivers from value-added tax (VAT), tax and customs tariff to: liquefied natural gas (LNG) import, apparel and other export sectors, power plants, capital machinery and some other sectors last fiscal year to facilitate industrialisation and infrastructure development.

If the tax benefits were not given and arrears were collected, total revenue collection would have grown 25 percent year-on-year, said NBR Chairman Md Mosharraf Hossain Bhuiyan yesterday at a press conference at his office.

A number of mega infrastructure projects -- Rooppur nuclear power plant, Padma bridge and Dhaka metro rail -- are being developed and tax breaks have been given to construction materials and machineries.

“But we have no regret. Development is taking place in the country and we will get benefit of the development later,” he added.

The NBR organised the event to share revenue collection figures in fiscal 2018-19 and measures taken to accelerate total tax receipts, which stood at 8.83 percent of the GDP, making it one of the lowest in the world.

VAT, a type of consumption tax paid by the final consumer, accounted for 39 percent of the total tax collection, followed by income tax at 32.6 percent and tariff from imports at 28.3 percent.

However, the NBR said total collection might increase to some extent in the final count.

This fiscal year, the NBR has been tasked to collect Tk 325,600 crore, which is 45 percent higher than the actual collection in fiscal 2018-19.

Bhuiyan is hopeful that the VAT collection would be higher this year for the use of electronic fiscal device (EFD), which the government would soon be supplying to 25 types of shops and businesses. The procurement order for 10,000 EFDs out of the planned 100,000 would be placed after the prime minister gives her approval, he said.

The NBR is also banking on a survey that it has been carrying out for the past couple of months to net more people who evade paying taxes despite having the capacity to do so.

At present, the NBR has about 40 lakh registered taxpayers but 22 lakh submitted returns in fiscal 2018-19.

Bhuiyan said four crore people in the country have the capacity to pay tax but the majority of them do not.

“We will try to bring them under the tax net gradually,” he said, adding that the tax administration has aimed to bring 6.72 lakh taxpayers into the tax net this fiscal year. As of June, the survey teams have detected 331,272 taxpayers and registered them.

“We are also taking punitive measures against the registered taxpayers who have not submitted tax returns.”

The NBR is taking measures against corrupt officials and conducts raid to prevent abuse of zero-duty import benefit of goods of various industries under bonded warehouse scheme by licence holders.

It has already suspended licences of 342 and is on way to cancelling some more for abuse of the benefit.