Govt formulates strategy to raise revenue collection

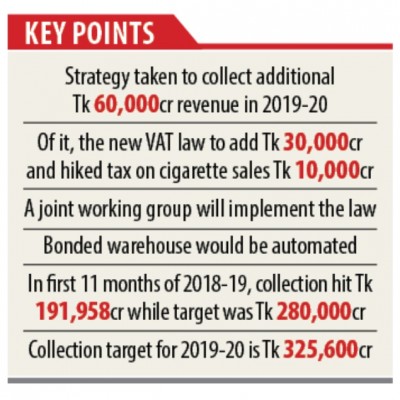

The government has devised a strategy to ramp up revenue collection by Tk 60,000 crore in the new fiscal year in order to help the National Board of Revenue (NBR) reach its tax mobilisation goal.

If the new plan is implemented, the targeted revenue can be generated from various sectors in the new fiscal year that began on July 1.

A senior official of the finance ministry said the government formulated the strategy to collect additional revenue as the tax administration has failed to reach the target in recent years.

The tax authority collected Tk 191,958 crore in the first 11 months of the just-concluded fiscal year against a revised goal of Tk 280,000 crore.

The NBR had to collect Tk 88,105 crore in June if it wanted to hit the target, an uphill task for the administration as it could not mobilise even half of the amount in May, according to the finance ministry official.

So, there might be a big shortfall in revenue collection in the final calculation at the end of the year.

The revenue collection target for fiscal 2019-20 has been fixed at Tk 325,600 crore, which means the NBR will have to mobilise Tk 100,000 crore more than the actual collection a year ago.

If the new plan can be implemented properly, it is expected that the annual revenue collection target can be achieved, the finance ministry official said.

The NBR expects to generate an additional Tk 30,000 crore through the implementation of the new VAT law, which came into effect on July 1.

A new joint working group will be formed with representation from both public and private sectors and additional workforce will be deployed to implement the law, the official said.

The government expects an additional Tk 10,000 crore from the increased tax that was slapped on the sales of cigarettes.

The government also has taken an initiative to automate the bonded warehouse facility so that businesspeople can’t misuse it to dodge taxes.

Every year, the government loses Tk 60,000 crore owing to the misuse of the bonded warehouse facility.

Finance Minister AHM Mostafa Kamal in his budget speech also said the government would install scanning machines to check misdeclaration during the release of imported raw materials from the bonded warehouses.

The finance minister has targeted to earn an additional Tk 10,000 crore in income tax from eligible taxpayers.

Currently, four crore people belong to the middle-income group in the country and most of them can afford to pay income tax, but only 22 lakhs of them do so, Kamal said.

The government plans to bring at least one crore people under the tax network. It has targeted to take the total number of income taxpayers to 50 lakhs in 2019-20.