Why is Bangladesh’s currency markets bearish when global stocks are actually on bull run?

Global stock markets saw almost a V-shaped recovery during the coronavirus pandemic. But Bangladesh's stock market is an exception.

A V-shaped recovery identifies a sharp fall in monetary activity, which is then matched by an abrupt rebound.

In fact, Bangladesh's currency markets followed suit when the global stocks dropped. Nonetheless it has refused to produce a turnaround when the global stocks rose.

The local market did not rebound even following the government rolled out an enormous stimulus package amounting to Tk 103,117 crore, which is 3.7 % of the GDP, to draw the overall economy out of the wreckage.

In the centre of the issues are inadequate methods on monetary expansion, self confidence crisis emanating from the shutdown of trading for the pandemic, the establishing of floor selling price and failure to manage the contagion.

"Although government has announced different special packages, liquidity shortage remains in the money marketplace and the interest of the banking sector is still great," said Shahidul Islam, ceo of VIPB Asset Supervision, which manages a lot more than Tk 160 crore.

Inadequate monetary expansion is the prime reason, Islam stated.

The stock markets all over the world began to plunge from later February when the virus started to spread globally. The fall lasted until past due March.

India's BSE Sensex dropped 35 per cent to 25,981 tips, the US's S&P 500 index slumped 32.96 % to 3,337 and Eurozone's Euro Stoxx 50 fell 37 % to 2,385 during the time. Likewise, DSEX, the benchmark index of the Dhaka STOCK MARKET (DSE), quit 16 per cent to stay at 3,974.

In past due March, countries began to announce special deals to regenerate their pandemic-hit economies.

THE UNITED STATES Senate passed a $2 trillion coronavirus aid bill, the major economic stimulus in america history, on March 26. Almost all the countries declared plans prompting stocks globally to bounce back.

Subsequently, the S&P 500 index rebounded 37 per cent to 3,066 in Tuesday from past due March. Through the same period, the Euro Stoxx 50 recovered 35 % to 3,229 and the Sensex regained 29 % to 33,605.

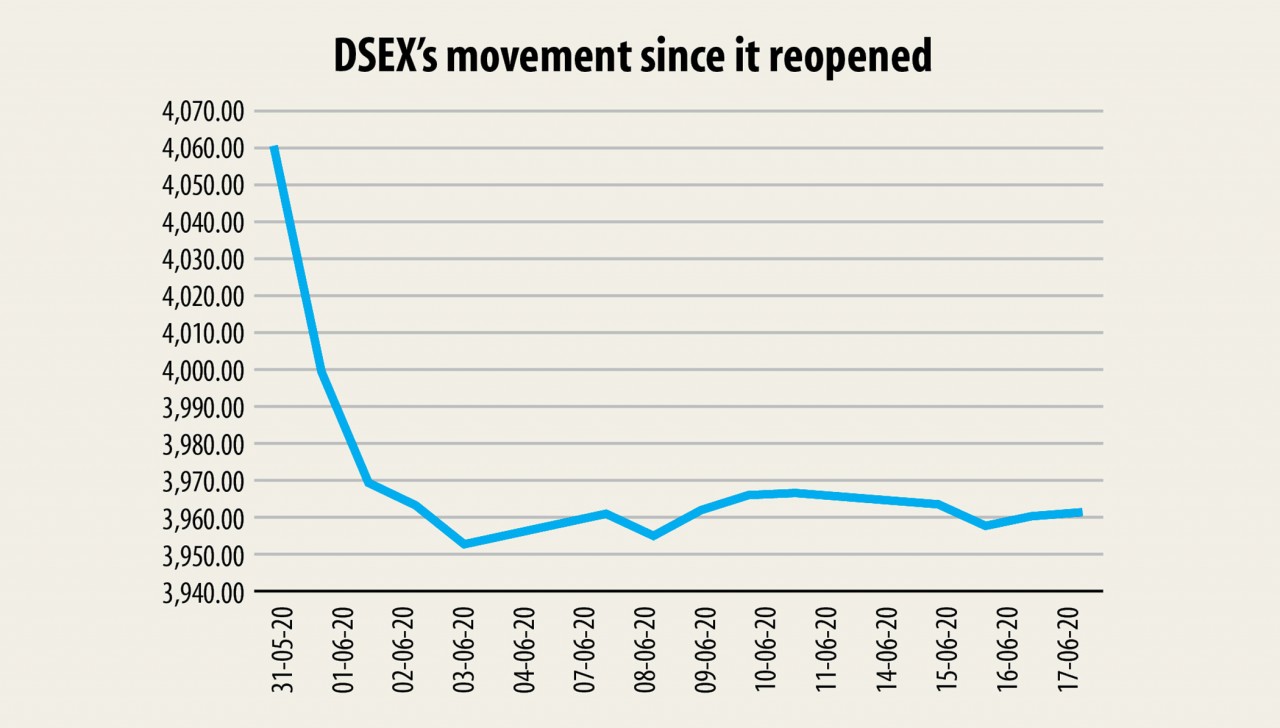

DSEX, however, dropped about 1 % to 3,960.

"It is necessary to reduce the interest found in the banking sector and the yield on government bonds. Otherwise, banking institutions would prefer the bonds to financing money to the exclusive sector and investing in stocks in this rough time," Islam said.

The Federal Reserve has recently announced its intent to get corporate bonds along with Treasury bonds to ease the monetary supply.

In India, the yield on government bonds is approximately 3 %, whereas it is up to 7 per cent in Bangladesh although rate of inflation is nearly the same in the two countries, the asset manager said.

"Regardless of the Bangladesh Bank's stage to help ease monetary supply, the united states needs more insurance policy support to make sure monetary growth because refinance schemes aren't adequate to tackle this unprecedented crisis," he said.

The central bank has reduced banks' cash reserve ratio, an expansionary tool, by 100 basis points to 4 % and repurchase agreement rate (known as the repo rate) by 50 basis points to 5.25 % to create funds cheaper for banks.

Another cause of the bearish market on Bangladesh is almost all of the investors are momentum-driven, therefore the index suffers when it needs to rise or fall, Islam added.

Momentum investors are actually those who make an effort to gain when the marketplace is rising and hurry to sell when the marketplace stays low.

Investors feel that Bangladesh economy would be in a poor shape although government has projected a great 8.2 per cent GDP development for next fiscal year, said AB Mirza Azizul Islam, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC).

"They fear the listed companies would perform badly. Hence, many of them aren't buying shares."

The cases of coronavirus are declining in many different countries whereas it really is rising in Bangladesh and this is another reason behind the pessimism, said the former caretaker government adviser.

The suspension of trading for a lot more than 8 weeks and the policy intervention to avoid the fall of the index were an enormous blow, said a merchant banker preferring anonymity.

Because of the traditional method still found in carrying out trade, both DSE and the Chittagong Stock Exchange had to stay shut from March 26 to May 30 through the countrywide shutdown put in place to support the contagion.

On March 19, the BSEC ordered the bourses to create the ground prices of stocks predicated on the average prices of preceding five times, to avoid the securities from sinking further more.

Such interventions spooked the confidence of institutional and international investors and the BSEC has recently realised it. However the regulator is still ready to scrap the floor price.

The global stock marketplaces saw some ups and downs within the last six weeks and they are bouncing again now. This is ordinary because if the marketplace falls, it would rise quickly, the merchant banker explained.

"The BSEC had tried to avoid the plunge. The regulator right now fears the market may fall even more if the floor price tag is lifted. Such insurance plan interventions possess impacted the self-confidence and the confidence would not come back suddenly."