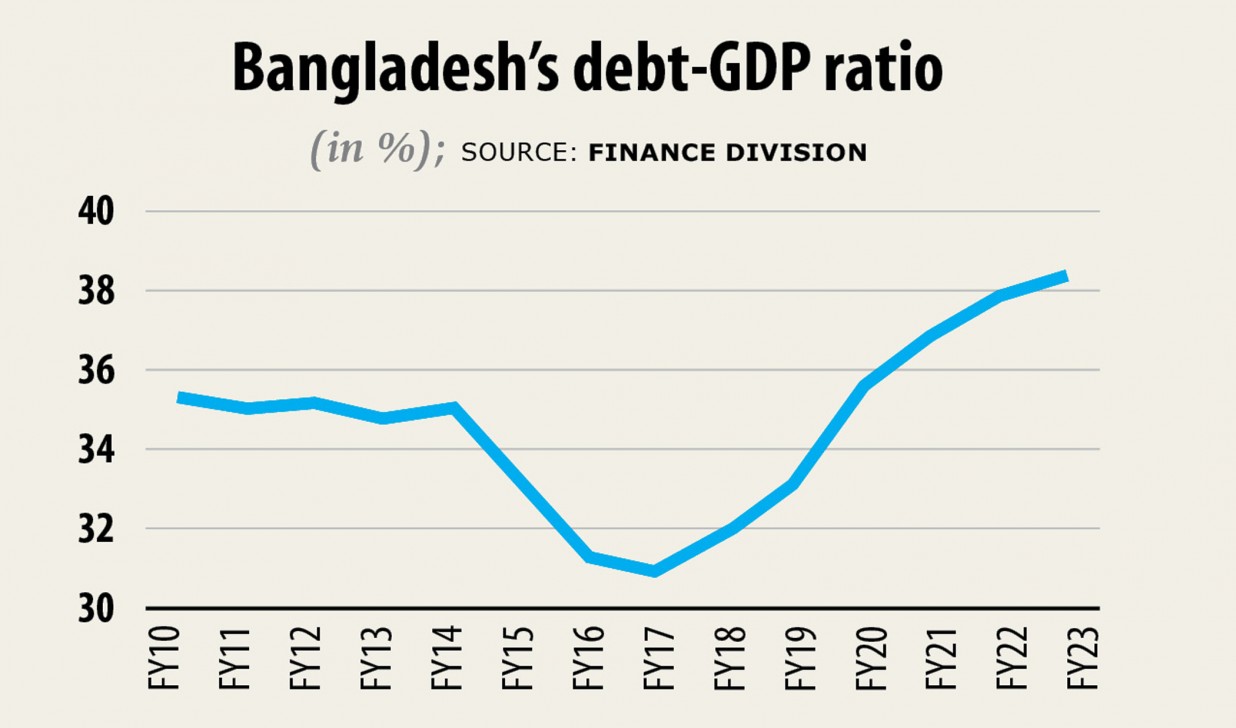

Pandemic nudging Bangladesh’s debt-to-GDP ratio away of comfort zone

The coronavirus pandemic is growing to be a a significant costly affair for Bangladesh, because of which its public debt-to-GDP ratio, which includes thus far experienced a healthy position, is defined to exceed the responsible threshold of 40 %.

In the coming years, Bangladesh's public debt-to-GDP ratio, which stood at 36 % at the end of 2019, would swell to about 41 per cent owing to increased borrowing to guard the two lives and livelihoods, the International Monetary Fund said.

"However, debt should remain sustainable," said Ragnar Gudmundsson, resident representative for Bangladesh of the IMF, on the crisis lender's website.

In a way, that is a testament to the sound economic and fiscal policies implemented recently, with limited aid dependency, prudent borrowing and, up until the crisis, adherence to a deficit ceiling of 5 per cent of GDP.

"Before the crisis, Bangladesh was in an excellent position, with a minimal risk of general and external debt distress," Gudmundsson said.

Just about the most densely populated countries on earth, Bangladesh exemplifies the triple blow that lots of emerging market countries have suffered from the pandemic: domestic slowdown caused by the condition and the efforts to contain it has the spread; a sharp decline in exports, especially of its main merchandise garment, and a decline in remittance.

It has left Bangladesh suddenly requiring additional funds.

However the updated debt sustainability analysis capturing the impact of the pandemic shock demonstrates debt remains at low risk of debt distress, the IMF explained earlier this month while approving $732 million in emergency financing.

Regardless of the adverse shock to expansion and exports, all exterior debt indicators are below their particular thresholds beneath the baseline and stress-test scenarios.

Open public debt also remains below its indicative benchmark beneath the baseline and stress-test scenarios, it said.

Higher economical growth, limited income shortfall, the right mixture of credit and secure foreign currencies helped keep carefully the public debt-to-GDP ratio at about 35 % for ten years from fiscal 2008-09.

The federal government has unveiled various stimulus packages amounting to $103,117 crore, which is 3.7 % of the country's gross household product, to help persons, businesses, entrepreneurs, farmers, industrialists and exporters counter the effects of the pandemic.

The stimulus packages will be the second-highest among the peer countries in Asia and the best in South Asia.

As a consequence, the total outstanding debt expanded by 1.7 percentage tips of GDP in the revised budget for fiscal 2019-20 from the initial one, the paper stated.

The debt level would rise by another 1.2 percentage points to Tk 117,000 crore found in fiscal 2020-21 when the majority of the stimulus deals would be implemented. Domestic debt would account for 63 per cent and the external financing 37 per cent within the next fiscal year.

The expense of funds for foreign financing continues to be less than domestic financing although external borrowing entails some forex risks.

Any devaluation of local currencies immediately enhances the price of overseas borrowing, the finance division paper said.

It will be relatively cheaper to finance the budget deficit counting on the external options and an appropriate mix of foreign and area loans would help cut funding credit debt expenditure and the entire outstanding debt.

The budget deficit for this fiscal year was estimated at Tk 145,380 crore. Nevertheless, the deficit in the revised budget provides been placed at Tk 153,513 crore, which is 5.5 per cent of GDP.

The entire budget deficit in fiscal 2020-21 will be Tk 190,000 crore, which is 6 % of GDP.

It really is expected that the market would receive momentum on the trunk of the implementation of the stimulus deals and the central bank's expansionary monetary policies, prompting the government to project 8.2 % GDP growth within the next fiscal year.

The growth projection is greater than 5.7 per cent forecasted by the IMF.

The reforms of debt management, the lower interest in the international industry and higher GDP growth would create a congenial environment for credit management in the near future, the finance division said.

"So, an uptick found in the debt-to-GDP ratio would not emerge as a matter of concern found in the medium term."

Experts, however, advise caution.

In the developed countries, the revenue-to-GDP ratio is 30 % to 35 % and the debt-to-GDP ratio is 70 to 100 per cent. This brings the debt-to-tax ratio to 300 per cent, relating to Ahsan H Mansur, executive director of the Policy Analysis Institute of Bangladesh.

Bangladesh's revenue-to-GDP ratio is 8.6 % and debt-to-GDP ratio 35 per cent. This means Bangladesh has a debt-to-revenue ratio greater than 400 per cent, he said.

Subsequently, Bangladesh is one of the highest indebted countries on earth regarding capacity to fork out, he told The Daily Star yesterday.

"We possess to be cautious now. If the existing trend continues, it will become unsustainable."

For Bangladesh, there is absolutely no scope for complacency and it must accelerate earnings generation, the economist said.

The government has recently cut its reliance on expensive nationwide savings certificates. This would go quite a distance towards decreasing the country's credit debt servicing expenditure, the financing division paper said.

International debt stood at $44.4 billion fiscal 2018-19, which was 13.4 per cent of GDP.

Bangladesh has already established to shell out $1.9 billion in basic principle and interest in the outgoing fiscal year, which is 5.1 % of the projected export incomes and 4.5 % of the earnings generation.

The threshold for foreign credit debt obligation for Bangladesh is 21 % of export proceeds and 23 per cent of government revenue, in line with the World Bank-IMF's joint credit debt stability analysis of 2019.

This implies, the foreign debt outstanding is less compared to the country could borrow, the policy statement said.