Income inequality to balloon like nothing you've seen prior

Income inequality is defined to inflate to an archive high this season, as the coronavirus pandemic continues to get rid of jobs and sweep away livelihoods, said the Centre for Policy Dialogue (CPD) yesterday.

The think-tank conducted an analysis to explore the implications of coronavirus in the short-term on poverty and inequality using the unit-level data of family members Income and Expenditure Survey 2016.

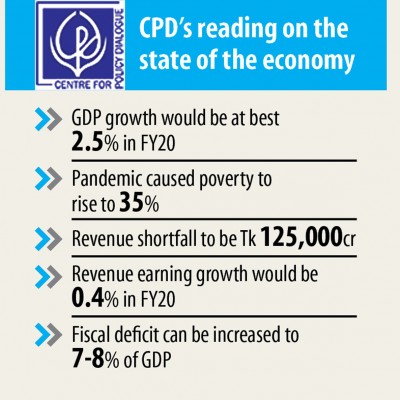

The analysis has applied negative shocks on household consumption in the number of 9-25 % among household groups. This led to a rise of national (upper) poverty rate to 35 % in 2020 from 24.3 % in 2016.

Simultaneously, consumption inequality, measured by the Gini coefficient, rose from 0.32 in 2016 to 0.35 in 2020 and income inequality went up from 0.48 in 2016 to 0.52 in 2020, the CPD said in its independent overview of Bangladesh's development, which was presented in a virtual media briefing yesterday.

The Gini coefficient is measured on a scale of 0 to at least one 1; the closer it really is to 1 1 the bigger the inequality is in the society. A figure above 0.5 represents a severe income gap.

"We've been saying for the last few years that one of the major weaknesses standing in the form of GDP growth keeps growing inequality," said Mustafizur Rahman, a distinguished fellow of the CPD, in his observation.

It isn't acceptable from the economics viewpoint and it is an ominous sign from the societal viewpoint, Rahman added.

Disruption of financial activities led to the increased loss of employment (in conditions of the amount of jobs or working hours), resulting in a decline in income for a huge section of the population, be it extreme poor, moderately poor, vulnerable non-poor or non-poor households, the CPD said.

Bangladesh's economy would grow at best 2.5 per cent this fiscal year because of the coronavirus pandemic, which, if materialises, would be the lowest in Bangladesh's history.

"We are thinking an excessive amount of about GDP despite this pandemic -- we have to come out of this," said Fahmida Khatun, executive director of the CPD.

Reforms should get the best priority.

"We have forgotten it. We neglect this each time. Reforms initiatives ought to be undertaken immediately. You will find a fascination about GDP growth," she added.

The pandemic is having a substantial impact on various aspects of the economy and will without doubt have important repercussions for fiscal 2020-21 budget, the think-tank said in a paper presented by Towfiqul Islam Khan, its senior research fellow.

However the research organisation, however, needed prioritising saving lives over everything.

"GDP growth rate shouldn't be the anchor outcome variable for monetary policies, like the national budget in the current context. Instead, the focus ought to be on saving the lives of folks in the country and reducing the vulnerabilities of the marginalised groups."

Both demand side (recession-induced) and offer side (lockdown-induced) disruptions are experiencing adverse implications for Bangladesh's macroeconomic and sectoral performance, as the economy is being adversely impacted through a host of transmission channels, both global and national.

"The true challenge perhaps lies ahead."

The pandemic would trigger an archive earnings shortfall of Tk 125,000 crore, it said, adding that earnings earnings in fiscal 2019-20 are likely to record a minuscule growth of 0.4 %.

"There is absolutely no beacon of hope regarding earnings mobilisation in fiscal 2019-20," the paper said.

Subsequently, it has become critically vital that you identify the resources of fiscal space to underpin the government's intended fiscal policy stance.

"Realistic earnings mobilisation targets will be crucial for overall fiscal management."

The CPD proposed the government to improve the tax-free income threshold levels from Tk 250,000 to Tk 350,000.

The first three slabs of tax from 10 per cent, 15 %, and 20 % could be restructured to 5 %, 10 %, and 15 % respectively, at least for the next two years.

To guarantee the food security of low-income people, the reduced amount of import-related tariffs on essential foods should be considered.

It is to be anticipated that demands for incentives will rise given the pandemic. "The principal objective of all tax incentives ought to be to directly support the marginalised groups."

It is time to lose the 'fat' in the non-development public expenditure which will be important to handle the adverse impacts of the pandemic with suitable fiscal measures, the CPD said.

The total annual development programme (ADP) for fiscal 2020-21 needs to ensure that the mandatory allocative priorities are followed and inclusivity is maintained.

Better utilisation of project aid in the upcoming fiscal years will determine the entire pace of implementation which is also important as a result of reducing the debt-servicing liability.

The bigger budget deficit is understandable but financing-mix remains an integral concern, the CPD said.

In the backdrop of subdued income mobilisation, the likelihood of pushing the budget deficit beyond the traditional cap of 5 % of GDP could be essential given the upcoming fiscal year.

"However, this increased budget deficit should be managed through the appropriate diversion of available resources, proper sourcing and prudent use of resources."

The Financial Institutions Division has a intend to make it mandatory for insurance firms to invest a particular part of their investible funds in government securities and invite investment of undisclosed income in the capital market, the CPD said.

However, such black money whitening facility through voluntary disclosure of undisclosed income and investment in capital market discourages honest taxpayers while tax evaders are encouraged."

"It has also didn't register any notable response. This provision shouldn't be continued from the next fiscal year."

With limited scope to further incentivise export and remittances, the central bank should consider gradual depreciation of the taka.

The government has come up with several policy interventions in the last couple of months in the sort of several stimulus packages and monetary easing, and by providing reliefs.

"Regrettably, the policy response has not been adequate. The federal government has relied generally on monetary policy tools (rather than fiscal stimulus as generally practised) as is manifested by the look of the stimulus packages."

The weakness of administrative capacity and insufficient good governance have further limited the potency of the federal government efforts, the paper added.

The next budget should be a cost-efficient one so that the federal government can implement it by spending less, said Khondaker Golam Moazzem, research director of the CPD.

There is scope to divert resources from sectors including the power sector to the important projects and areas.

The CPD said the financial policies in response to the pandemic during the last couple of months were influenced by the false dichotomy between life and livelihood.

Putting the so-called 'life versus livelihood' debate up for grabs has misguided the policy discourse.

The decision to open up economical activities without taking proper precaution, plan and preparation is having a substantial cost with regards to lives and sufferings of the citizens and sustainable recovery of the economy.

It is critically vital that you review the current state of the pandemic spread and take a planned phased method of allow movements and economic activities.

"Saving people from loss of lives and sufferings ought to be the highest priority. The economic recovery ought to be measured and monitored with regards to poverty, inequality and employment," he added.