When regulatory intervention does considerably more harm than good

Ten years ago, a verbal directive from the regulator to avoid the practice of forced-sale hit the currency markets hard and the impacts remain being felt nowadays.

Similarly, the floor price setting put in place in the wake of the coronavirus pandemic possesses practically been doing the same, analysts say.

"Regulatory intervention to save lots of the currency markets index is pretty unexpected. If they make an effort to do it, the market gets hurt. It had been proved in the event of stopping the pressured-sales," said a high official of a secured asset management company.

The Bangladesh Securities and Exchange Commission (BSEC) intervened in 2011 in a bid to prevent the forced-sale by stock brokers and merchant banks.

It came after most of the stock agents and merchant bankers provided margin loans to standard investors to get stocks through the bullish market in 2010 2010.

When the market began to plunge, the brokers and merchant bankers started to sell the stocks from the investors' account to change the credit just as the borrowers didn't repay loans. The practice is named forced-sale.

Almost all the overall investors together with the regulator stopped the lenders from doing this, assuming the action would hasten slump and investors would incur losses.

"The results of deterring the forced-sales had been so devastating that people were scared to execute forced-sales," explained a merchant banker, adding that the regulator could not refrain the index from dropping.

As the shares bought through the margin loans weren't sold and the costs collapsed, most investors didn't receive any penny back from their investment, he explained.

Agents and merchant bankers have got still been experiencing the losses stemming from the margin loans although a decade has passed since then.

Losing from the margin loans was a lot more than Tk 11,100 crore. Some agents and merchant bankers booked their damage plus some others are but to follow suit.

The institutional investors nonetheless can't invest in the market as a result of the losses, said the merchant banker.

Curbing the forced-sales was an example of breaches of laws and regulations and general norms of the world stock market and it had been deadly for the market though it looked good initially, said a stock broker.

In the same way, the floor price would be another cause for a huge blow for the market in the upcoming days, he added.

The BSEC set the ground price on March 19 with a view to stopping the index from plummeting further more amid the pandemic, bypassing the forces of the market.

On your day, the commission put in place the floor selling price of all stocks considering the last five-days average price. This might be the cheapest price until the provision is scrapped.

"When you obstruct the no cost movement of the inventory price determined by the industry forces, the marketplace would definitely go down. We witnessed it in case of margin loans," explained the stock broker.

The newly appointed commission is convinced that the ground price should be scrapped but it fears that there could possibly be protests from investors because they don't realise the outcomes of the floor price.

The floor price would affect the tiny investors most. Big traders can trade stocks on the block market but tiny cannot, said a high official of an asset management company.

"It is seriously eroding the self confidence of foreign investors as well because they definitely prefer a liquid market. But the floor cost has made the market illiquid."

The average turnover at the Dhaka STOCK MARKET fell to Tk 60 crore following the floor price was introduced, way down from Tk 450 crore prior to the policy intervention.

"The picture of the market provides been tarnished globally and overseas investors wouldn't normally want to invest in the market later on."

An identical initiative was taken by the Karachi STOCK MARKET (KSE) in Pakistan through the global financial meltdown of 2007-08 as a way to halt a sharp fall in its marketplace index. Following the floor price program was scrapped, securities declined drastically.

"It is confirmed that the ground price is not effective what sort of government thinks of it," an asset manager said.

If the ground price lingers, the majority of the brokers and merchant banks will be compelled to cut salaries and jobs of their employees and shut branches amid thin trading activities, said another stock broker.

"You can't keep a good stock selling price at some level artificially. If you make an effort to do so, it could spook investors' confidence and sow the seed for a market crash," he said.

The market has been falling around the world because of the pandemic which is normal as the gains of listed companies are set to decline in today's year in the the majority of sectors as a result of the collapse popular.

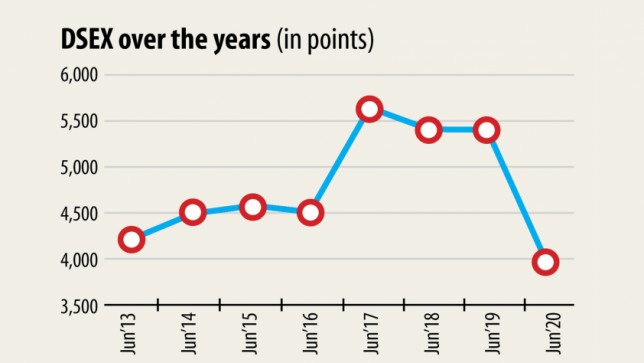

"On the other hand, the index would rebound alone when the pandemic peters out. Hence, the regulator's intervention in price mechanism is very unexpected."