Trade deficit narrows

Trade deficit squeezed by 8.42 percent in the first eight months of 2018-19 thanks to the steady growth of exports and a slowdown in imports, giving some breathing space to the government in managing the economy.

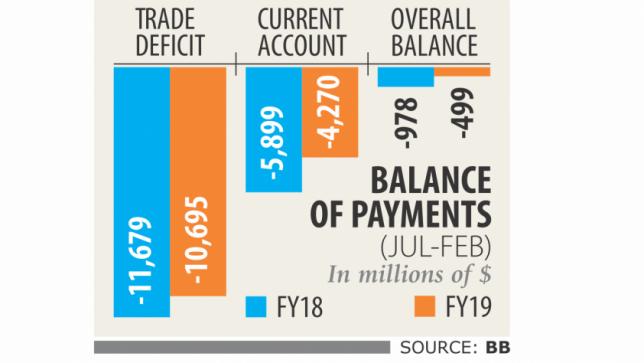

Between July and February, the deficit stood at $10.69 billion, down from $11.67 billion in the same period a year ago, according to data from the central bank.

The development, however, will not sustain because of a potential import growth in the months to come, analysts said.

The import growth will pick up shortly, sweeping aside the economic stalemate stemming from the uncertainty surrounding the national pools held in December last year, they said. Exports stood at $27.14 billion in the first eight months of 2018-19, up 12.44 percent year-on-year. Imports rose 5.64 percent to $37.83 billion.

The export has been on a rising trend since the turn of the year but the foreign exchange earnings from the segment have been highly dependent on garments, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He stressed the need for giving more focus on diversifying export goods and destinations to make sure sustainable earnings of foreign currency.

“Otherwise, the country will face a big trouble in the near future in managing foreign exchange-related liabilities and earnings.”

Mansur, also a former official of the International Monetary fund, said the import growth will not hover around 5 percent as it will jump soon because of the ongoing implementation of mega infrastructure projects.

Besides, many businesses were forced not to open letters of credit in the last few months because of the shortage of foreign currency that shrank imports artificially, he said.

The deficit in the current account has also gone down but the sum is still sizable.

The current account deficit decreased 27.21 percent year-on-year to $4.27 billion between July 2018 and February 2019.

“The large current account deficit clearly indicates that the foreign debt is on the rise. It has put a negative impact on the foreign exchange reserve.”

As of February, the reserve stood at $32.23 billion, down 3.40 percent from a year earlier. The reserves are able to settle import payments for a maximum 5.1 months, down from 5.8 months a year ago.

Mansur advised the central bank let the market determine the exchange rate and stop its regular intervention so that the local currency depreciates against the US dollar.

The depreciation will push up export earnings and discourage the imports of luxurious items. There is no other immediate option but to attract foreign direct investment (FDI) to ease the tight situation in the foreign exchange market, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh.

“The economy will get momentum if more FDIs flow into the country,” he said.

Although, the FDI has increased in recent times, it is still quite low considering the size of the GDP, said Rahman, also the managing director of Dhaka Bank. Net FDI inflow stood at $1.18 billion in the July-February period, compared to $948 million registered during the same period a year ago.