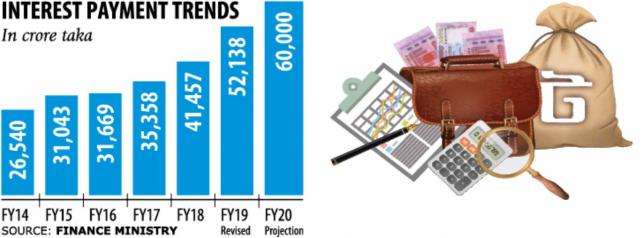

Tk 60,000cr for interest payment

The government’s interest burden is likely to get heavier in the upcoming fiscal year thanks to its excessive reliance on high-cost national savings certificates to fund its expenditures.

Some Tk 60,000 crore might be set aside for interest in fiscal 2019-20’s budget, up 15 percent year-on-year, said a finance ministry official requesting anonymity.

The rate of interest on savings certificates stands between 11 percent and 12 percent depending on the type of savings scheme.

On the other hand, the government’s borrowing from banks, the interest rates for which range from 2 to 8 percent, has declined in the face of rush of people for savings certificates.

The low interest rates on banks’ deposit products are the major factor behind the spiralling sales of state-sponsored savings instruments. This fiscal year, the government planned to borrow Tk 71,226 crore from domestic sources.

Of the sum, it wanted to take Tk 42,029 crore from banks and the rest from non-banks, which include savings certificates.

However, the government did not borrow from banks in the first nine months of the fiscal year; instead, it repaid Tk 2,407 crore, according to Bangladesh Bank.

The government’s non-bank borrowing rose 11 percent year-on-year to Tk 41,956 crore during the period thanks to a surge in the sales of savings certificates.

Borrowing from net sales of savings, which was only Tk 479 crore in 2011-12, shot up to Tk 11,707 crore two years later.

Now, it has ballooned more than four times that of fiscal 2013-14.

In the face of soaring dependence on the high-cost borrowing and cautions by the economists and international donor agencies like the International Monetary Fund on the intensifying debt burden, the government has decided to take initiatives to reform the national savings system.

It is yet to bring any reforms though dreading the ire of various quarters, the finance ministry official said.