MFS limits jacked up

The Bangladesh Bank yesterday raised the transaction ceiling for mobile financial service following requests from industry players with a view to promoting the alternate payment platform.

The move comes two and a half years after it had lowered the ceiling on the ground that the facility was being abused by vested quarters.

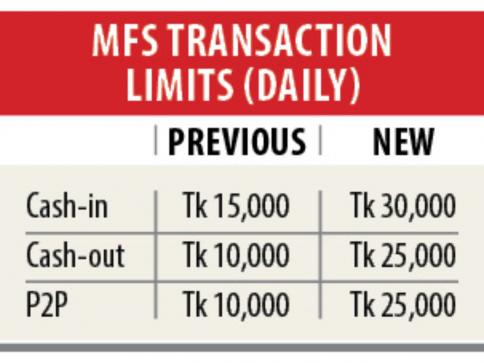

From now on, a maximum of Tk 30,000 can be deposited into an MFS account in a day, up from existing Tk 15,000. The monthly transaction ceiling has been doubled to Tk 2 lakh, according to a notice.

An individual can now deposit money into his/her account five times a day, up from two at present. In a month, he/she can make deposits 25 times as opposed 20 times now.

The daily withdrawal limit was increased to Tk 25,000 and monthly ceiling to Tk 1.50 lakh, from Tk 10,000 and Tk 50,000 respectively.

A person can withdraw money from an account five times a day, up from two previously. Their monthly withdrawal limit has doubled to 20 times.

However, the banking regulator has not mentioned anything about the charges for withdrawing money, which is now 1.8 percent of the transaction amount. For account-to-account transfers, the ceiling has been raised to Tk 25,000 daily from existing Tk 10,000 and to Tk 75,000 monthly from Tk 25,000.

A person can maintain at most Tk 3 lakh in an MFS account.

The ceiling is not applicable for other mobile banking services like merchant payment, online and e-commerce payments and so on.

Earlier in January 2017, the central bank had brought down the transaction limit and put some restrictions on holding multiple MFS account under the same national identity card.

Shamsuddin Haider Dalim, head of corporate communications at bKash, said they are welcoming the move as it will help forward the government’s financial inclusion agenda.

“Our economy has grown a lot over the years and people are earning and spending more than before. That’s why lifting the transaction limit became the need of the hour.”

Over the years, the MFS providers have brought in lots of services and people are now comfortable using the platform to buy goods and services, pay bills and disburse salaries. “That’s why bKash has made a demand before the central bank,” Dalim added.

The lowering of transaction limit hit the MFS players hard once the Bangladesh Post Office came up with its digital financial service platform Nagad in March last year.

Nagad had subsequently higher transaction limits and was not bound by restrictions like the MFS players bKash, Rocket and UCash as its activities fell outside the purview of the central bank.

Through Nagad, a customer will be able to make 10 transactions a day amounting to Tk 250,000 and send Tk 50,000 in one transaction. The numbers are the same for withdrawals.

“The private players of the MFS platform put pressure on the central bank to raise the transaction limit to remove the uneven competition,” said a senior executive of the Bangladesh Bank.

The transaction limit was revised upwards accordingly, he added.

In March, about 3.24 crore MFS users transacted Tk 34,678 crore through the platform, up 10 percent from the previous month, according to the central bank.