Govt’s bank borrowing hits six-year high

The government has all on a sudden stepped up its borrowing from the banking system from this month as its revenue collection fell short of expectations, sending the cash-strapped banks into a state of panic.

Until the end of April, the government did not borrow from banks; rather, it paid back Tk 1,083 crore, according to data from the Bangladesh Bank.

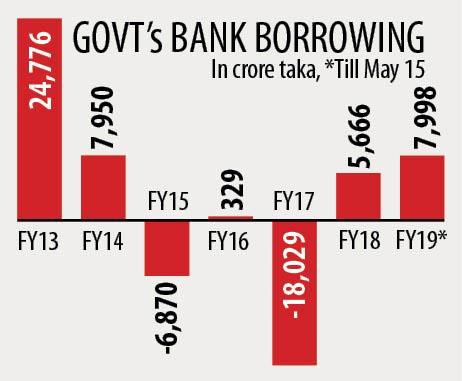

But from this month it started borrowing; as of May 15, it has taken Tk 7,998 crore, which is the highest in six years.

The government had earlier targeted to borrow Tk 2,725 crore from commercial banks in May. But in the second week of this month, it has revised the amount to Tk 6,725 crore.

The change in stance comes as revenue collection is poised to fall short of target by a big margin this fiscal year, with receipts growing the lowest in five years in the first nine months due to sluggish collection of customs tariff and value-added tax.

Between July last year and March this year, the National Board of Revenue managed about Tk 153,419 crore in collections, up 7 percent from a year earlier, as per its provisional data. The amount missed the periodic target by nearly Tk 50,500 crore.

The government has assigned the NBR to collect Tk 296,201 crore in fiscal 2018-19, meaning the revenue authorities will have to collect more than Tk 142,000 crore in the remaining three months to meet the target, which seems highly improbable.

Amidst this, the government’s need for funds has now gone up.

The government will have to pay festival bonus before Eid-ul-Fitr, scheduled for the first week of the next month, to its thousands of employees and also release funds for development projects, the implementation of which accelerates towards the end of a fiscal year.

So, it has now turned to the banking system.

“That has triggered panic amongst banks,” said Ahsan H Mansur, executive director of the Policy Research Institute.

The government though has set a borrowing target of Tk 42,029 crore from the banking sector this fiscal year.

But a little borrowing has left banks on edge as they are struggling to attract deposits, said a BB official.

Savers continue to park their funds in national savings instruments for their higher returns.

In the first nine months of the fiscal year, the government sold savings certificates amounting to Tk 39,733 crore, which is 66 percent higher than its full-year target.

“Were the interest rates on savings tools in line with what the banks offered for their deposit products, banks would not have been in the liquidity crisis that they are now,” the official added.

Mansur called for slashing of interest rates on savings tools immediately to bring an equilibrium between the rates of the government and banks products.

The ongoing liquidity crunch will get worse if the government continues to borrow from banks, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks’ managing directors.

“Some banks, which enjoy strong liquidity base, are unwilling to lend money through the call money market. Rather, they show interest in providing funds in the form of placement” he said.

The interest rate in the call money market ranges 4.50 to 4.60 percent, whereas the rate for placement funds goes as high as 12 percent. Rahman, also the managing director of Dhaka Bank, called for allowing government agencies to keep their deposits with private banks.

Earlier in August last year, the finance ministry took a decision to keep 50 percent of the government deposits in private banks and 14 non-bank financial institutions, up from the previous ceiling of 25 percent.

In fiscal 2017-18 the government borrowed Tk 5,666 crore from the banking sector; it did not borrow any money the previous fiscal year but repaid Tk 18,029 crore. “The upward trend of the government borrowing will not end in just one or two months’ time. It will prolong because of the government’s imprudence in managing the macro-economy,” said Mansur, a former economist of the International Monetary Fund.