State banks' bad loan recovery falters

Five state-run banks made half-hearted efforts in the first half of the year in recovering their non-performing loans, which account for 47 percent of the total default loans in the sector.

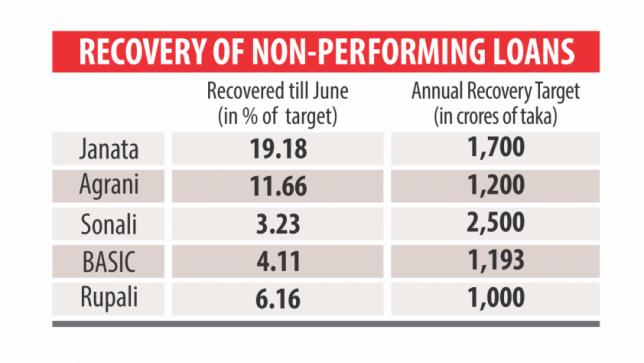

Between the months of January and June, Sonali, Janata, Agrani, Rupali and BASIC managed to retrieve 8.74 percent of their bad loan recovery target of Tk 7,593 crore for the year.

At the end of June, total non-performing loan of the banking sector stood at Tk 89,340 crore.

Default loans in state banks escalated in recent months thanks to disbursement of a large amount of loans to unscrupulous persons without their business profile being verified, said a Bangladesh Bank official.

The number of habitual defaulters has increased, he said.

“This is a red alert for the banking sector. The defaulters think that nothing will happen if they do not repay the loans.”

Besides, recovery efforts have been underwhelming as many of the large borrowers could refrain from repaying the loans because of their close relationship with the political quarters and the high-ups of the banks, the BB official added.

Of the five banks, Janata made the highest recovery in the first half of the year: 19.18 percent of its annual target of Tk 1,700 crore.

It was followed by Agrani, which recovered 11.66 percent of its annual target of Tk 1,200 crore.

Sonali realised only 3.23 percent of its annual recovery target of Tk 2,500 crore, BASIC 4.11 percent of Tk 1,193 crore, Rupali 6.16 percent of Tk 1,000 crore.

Mohammad Shams-Ul Islam, managing director of Agrani Bank, said the state-run bank's default loan recovery has been tepid as there were many bank holidays in the first six months of the year.

“Many of our recovery officials were in a relax mood. But we have recently turned the situation around,” he said, citing the bank's recovery of Tk 40 crore in the month of September alone to further his point.

Islam went on to blame the habitual defaulters who frequently file writ petitions with the High Court to get their default loans unclassified on the poor recovery.

Banks' recovery efforts are typically sluggish in the first half of the year, said Md Ataur Rahman Prodhan, managing director of Rupali Bank.

He hopes that Rupali would be able to recover at least 50 percent of its annual target as it has realised a handsome amount of default loans in the third quarter of the year.