Banks' capital base weakens further

The banking sector's capital base weakened further in the second quarter this year on the back of deteriorating asset quality of banks, as per the Bangladesh Bank's latest data.

As of June, banks' capital adequacy ratio (CAR), which determines the adequacy of banks' capital keeping in their risk exposures, stood at 10 percent, down from 10.11 percent a quarter earlier.

Banks are required to keep at least 11.817 percent CAR including capital conservation buffer as per roadmap set by the central bank to implement Basel III, said a BB official.

“But the banking sector fell short of maintaining the regulatory requirement.”

He went on to call for immediate measures from the central bank to stave off the brewing tension.

“The banking sector has become a matter of concern,” said AB Mirza Azizul Islam, a former adviser to the caretaker government.

The World Bank too expressed concern about the state of the banking sector while unveiling the Bangladesh Development Update report on Tuesday, he said.

The government though would not take any measures to address the situation because of the upcoming general election.

Islam went on to criticise Finance Minister AMA Muhith's initiative to prepare a roadmap for his successor in the next government to salvage the ailing banking sector.

“Why did the minister not do anything to protect the banks from the ongoing situation?”

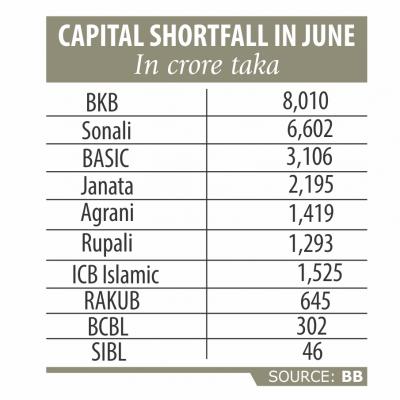

In a further indication of the progressively precarious state of the banking sector, ten banks, including seven state-owned ones, ended up with a capital shortfall of Tk 25,143 crore at the end of June.

The banks are: Sonali, BASIC, Rupali, Janata, Agrani, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, Bangladesh Commerce Bank, ICB Islamic Bank and Social Islami Bank. Social Islami, which went through an ownership change last year, entered the negative territory for the first time in recent years.

“This is not a good indication for the banking sector,” Islam said.

Since 2009 the government has injected Tk 14,505 crore into state banks but they are yet to show any sign of strengthening their capital base.

Of the ten banks, BKB had the highest amount of capital shortfall of Tk 8,010 crore, followed by Sonali at Tk 6,602 crore, BASIC at Tk 3,106 crore and Janata at Tk 2,195 crore.

The scale of capital shortfall in the state-run banks is expanding at the same pace as the default loans, Islam said.

The state-run banks have either disbursed large amounts of loans to those with political connection or to influential people, he said.