Banks' profit rises 20pc

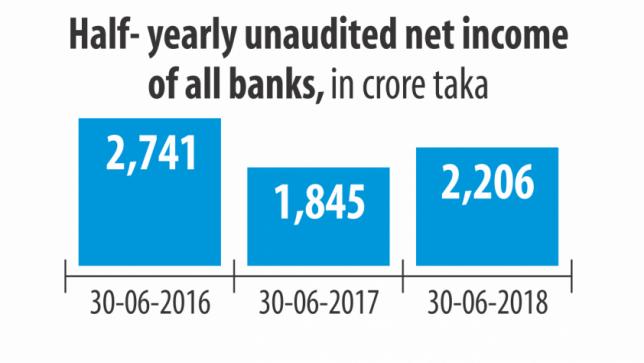

Banks' net profit soared 19.55 percent in the first six months of the year, compared to the same period a year ago, propelled by impressive performance by a few private lenders.

Between the months of January and June, the banks raked in profits of Tk 2,206 crore, according to the provisional data received by the Bangladesh Bank.

During the period, they logged in operating profit of Tk 11,358 crore, from which Tk 3,929 crore was deducted as tax and Tk 5,223 crore as provisioning against bad loans.

In truth, only a few banks managed to bag handsome amounts of profit, which has flattered the entire sector's performance in the first half of 2018, said a BB official.

“It is not possible to register net profit growth if default loans are on the rise,” he said, adding that most of the banks either managed marginal profit or faced negative net income in the first half of the year for the spiralling default loans.

As of June, the banking sector's total default loans stood at Tk 89,340 crore, up 20.23 percent from six months earlier.

Banks that were able to restrain their non-performing loans registered good net profits, said MA Halim Chowdhury, managing director of Pubali Bank.

Pubali's net profit more than doubled to Tk 203 crore in the first six months of this year.

“We kept huge amounts of provisioning against our default loans last year. But in recent months, we have successfully managed to control our classified loans, which ultimately had a positive impact on our net income.”

Among the private banks, Brac Bank recorded the highest net profit of Tk 643 crore, followed by Standard Chartered at Tk 499 crore, Sonali at Tk 327 crore and Islami at Tk 312 crore. Brac Bank Managing Director Selim RF Hussain, however, disputed the figure put out by the central bank about his bank's net profit in the first half of the year.

“This figure is not correct and my bank did not log such a large amount of net profit in the period,” he said.

The bank's financial report showed that its net profit after tax stood at Tk 273 crore.

Among the private lenders, Bank Asia put up a strong showing in the first six months of the year: its net profit shot up 75.71 percent year-on-year to Tk 123 crore, according to data from the central bank.

The bank's balance sheet has expanded substantially in the recent period, which was reflected on the higher net income, according to Md Arfan Ali, managing director of Bank Asia.

Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of the managing directors of private banks, said banks should not be complacent about the half-yearly net profit data as the picture may change at the yearend.

He, however, said that the net profit growth is linked to the private sector credit growth.

“The credit growth ranged from 18.36 percent to 16.96 percent between January and June. So it was logical that the sector's net profit grew 20 percent,” said Rahman, also the managing director of Dhaka Bank.

The six state-run banks, however, collectively registered a net loss of Tk 1,234 crore in the first half, against Tk 1,047 crore a year earlier.