BASIC Bank's losses widen for bad loans

The rising nonperforming loans have continued to widen the loss of the scam-hit BASIC Bank.

In the six months to June this year, the bank's loans worth Tk 239 crore were classified, according to central bank data.

As of June, the amount of classified loan of the state-owned lender hit Tk 8,443 crore, which is 56.43 percent of the total outstanding loan.

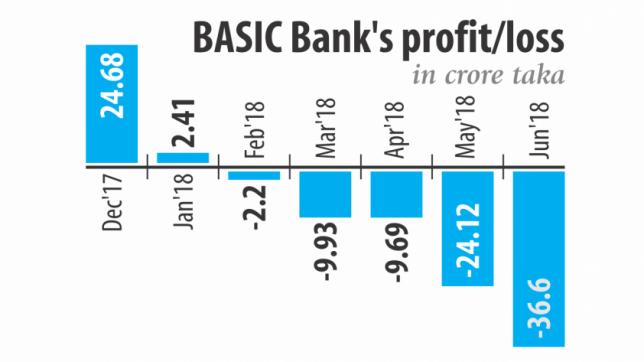

The bank made a profit of Tk 24.68 crore in December last year, which fell to Tk 2.41 crore in January this year.

The bank's loss started widening in February when it lost Tk 2.2 crore and the figure hit Tk 36.6 crore in June this year.

The rising default loan is another big problem for the bank, said its Chairman Alauddin A Majid. The bank rescheduled loans of Tk 349 crore in 2018's January to June period while it rescheduled a total of Tk 1,737 crore loans in the previous two years. The rescheduled loans may become default again because of the non-payment of regular instalments by the clients, he said. The substantial decline in profit put pressure on its management prompting Managing Director Muhammad Awal Khan to resign.

Khan, who took charge in November last year, tendered his resignation at a meeting of the board on August 14.

The financial health of the bank is not improving because of the failure of the management, Majid said.

The management is not confident enough to take any decision, he said.

In the four years between 2009 and 2013, Tk 4,500 crore was swindled out of BASIC Bank, once a healthy public bank, in the country's biggest financial sector fraud.

The scam left the bank officials in a state of fear and the top management could not motivate them, resulting in the deterioration of financial indicators, Majid said.

“The bank needs to undertake massive business expansion activities but the officials are shy of giving big loans.”

Some clients had their loans rescheduled by paying down-payment but they did not continue to pay instalments, he said. The clients might have some bad intentions, but the bank has also failed to tackle the situation, he said.

The bank regularised the loans without proper assessment of cash flow or failed to motivate the borrowers to keep repaying loans, the chairman said.

The outstanding loans of the bank's top 20 defaulters rose to Tk 2,240 crore in June from Tk 2,122 crore in December.

“BASIC Bank managed to recover only Tk 4 crore in the first six months of the year.”

It recouped Tk 49 crore in January to June from the defaulters while the figure was Tk 158 crore last year.

Net interest margin was 0.52 percent in the negative in June as the bank's higher interest expense dwarfed its income, according to central bank data.

The bank's capital shortfall also widened to Tk 3,106 crore at the end of June compared to Tk 2,656 crore in December.