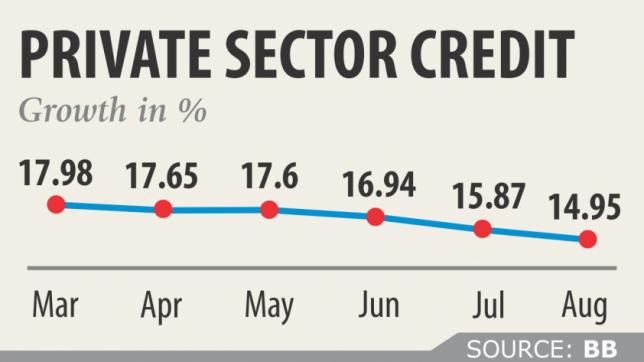

Private credit growth hits 31-month low

Private sector credit growth hit a 31-month low of 14.95 percent in August as investors shy away from business expansion due to the upcoming national election in December.

The development will bring much cheer to the Bangladesh Bank as this is the first time in about a year that the growth rate has been below its ceiling. The private sector credit growth target for the second half of the year is 16.80 percent.

Banks have enough money but investors are unwilling to take investment decisions ahead of the election, said Md Arfan Ali, managing director of Bank Asia.

The central bank's decision to slash the loan-deposit ratio by 1.5 percentage points to 83.5 percent was one of the main reasons behind the declining credit growth, according to bankers.

On January 30, the BB instructed banks to implement the new ratio by March next year. More than 25 banks were above the authorised limit of the ratio in December last year.

“Some banks that lent aggressively in the first half of the year are now adjusting their portfolio,” Ali said.

Most of the banks have brought down their loan-deposit ratio in line with the central bank's instruction, said a senior BB official.

“As a result, credit growth has slowed recently. But the trend is normal as it remained within the central bank's ceiling,” he added.

At the end of June, the average loan-deposit ratio stood at 76.66 percent.

The total credit to businesses stood at Tk 9,101,659 crore at the end of August, according to data from the Bangladesh Bank.

Meanwhile, public sector credit growth was 5.92 percent in August, far below the ceiling of 8.60 percent set for the July-December period.

In another development, the weighted average lending rate in the banking industry came down to 9.63 percent in August from 9.71 percent the previous month, according to data from the BB.

On June 21, the Bangladesh Association of Banks, a forum of directors of private banks, decided to lower the interest rates on lending and deposit to 9 percent and 6 percent respectively.

The new rates came into effect on July 1, but most of the banks are still lending at double-digit.