Should Bangladesh copy Aadhaar?

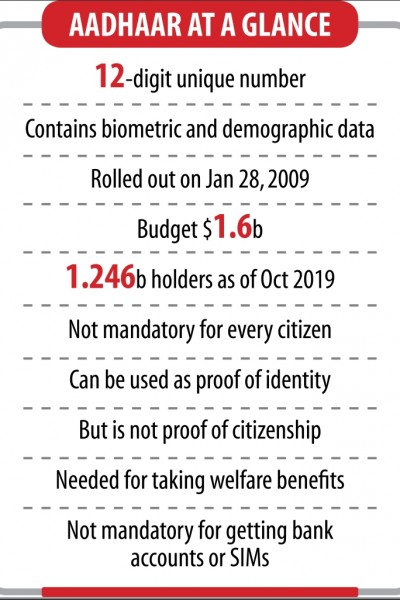

Aadhaar is a one-time identity card issued by the Unique Identification Authority of India (UIDAI) free of cost for all residents of India, making it the world’s largest biometric identification programme.

The scheme is expected to have lasting and extensive effects on the welfare of the people, efficiency of law enforcement and governance, which are principal entitlement to national security.

It contains a 12-digit unique number and is registered by taking a person’s biometric details such as fingerprints and demographic data.

The card was initially issued to create a more rationalised and transparent process of allotting certain government benefits and subsidies for Indian citizens.

Now, the benefits and usage have evolved as a payment system, tax regulator and much more, making it an essential document for all Indian residents.

For example, one must present their Aadhar card in order to open a bank account, apply for loans, get benefits from pension schemes, register their passport, take exams and many more. It has also been made mandatory for a person to link their bank accounts to their Aadhar card to enjoy government subsidies.

Aadhaar become an invaluable weapon for the income tax authorities. As the card is linked to a person’s bank accounts, they can keep tabs on those who do not declare or declare a small amount as their taxable income but spend luxuriously.

The authorities are notified when an individual opens a bank account, pays bills amounting to more than Rs 50,000 and the sale or acquisition of goods and/or services exceeding Rs 2 lakh in a single transaction. This helps them seek out tax evaders and widen tax net.

Prime Minister Narendra Modi launched ‘Aadhaar Pay’ in 2017 with the effort of shifting India to a cashless economy and a digital payment drive for those who are unable to acquire credit and debit cards.

This payment system enables merchants to collect payments seamlessly from their customers using their Unique ID (UID) and biometric verification.

Merchants only need to invest in a smartphone for the app and a biometric device for verification. The transaction is safe and secure, efficient and allows easy reconciliation for the trader.

Moreover, transaction costs are also low since the seller receives 0.5 per cent of transaction value and pays minimal merchant discount rate.

For consumers, payment has been made as convenient as possible. They only need to present their pin; no smartphone is necessary if they do not wish to see the payment notification.

The biometric system and needlessness for cash has reduced security concerns broadly.

The Indian newspaper Business Standard reported that the government offices have seen employees spend an average of 20 minutes more at work place since using the UID to check attendance.

The chief executive officer of Invest India Micro Pensions mentioned that the introduction of electronic Know Your Client has led to a reduction of document processing time and costs by 50 per cent.

The secretary of School Education of the Government of India believes that, potentially, public school teachers in rural areas, who typically have low attendance, could be monitored using the UID.

However, poor network and high costs of biometric readers act as major barriers to this solution.

An empirical study also deduced that Aadhaar has direct value in digital infrastructure creation through which financial and social transfers occur.

The study further finds that previously marginalised individuals are more included in welfare programmes.

Another paper reported that Aadhaar Pay could enable an interoperable agent network across the border, which can theoretically execute government payments whilst also offering financial services to the financially excluded.

However, numerous privacy concerns were raised by the general public as the Aadhaar database is an information mine, easily accessible by one’s UID.

To mask the UID, in the middle of 2018, the virtual ID (VID) was launched, which is a temporary, randomly generated number. However, a law for privacy protection is also imperative as that would make Aadhaar more trustworthy and secure for the nation.

The Bangladesh National ID (NID) was primarily used as a voter ID when it was first introduced.

Now, with the launch of the latest biometric ID the NID has been made compulsory for: vehicle and SIM card registration, passport application, few banking operations, getting trade licences, tax payments, share trading and 22 other activities.

However, when compared to the vast amount of useful services provided by Aadhaar, the NID is lagging far behind. Bangladesh Bank has recently had a focus on financial inclusion with microfinance institutions, mobile financial services and more. The introduction of a payment system through the card would highly support this and aid the economy as was seen in India. Moreover, the introduction of an integrated procedure for tax collection with the NID would most certainly increase government revenue.

The author is a partner at PricewaterhouseCoopers Bangladesh