Robi debut buoys stocks to 16-month high

Stocks soared to a good 16-month on top of the trading debut of cellular phone operator Robi Axiata, buoyed by basic investors' investing in spree and increased participation from institutional investors.

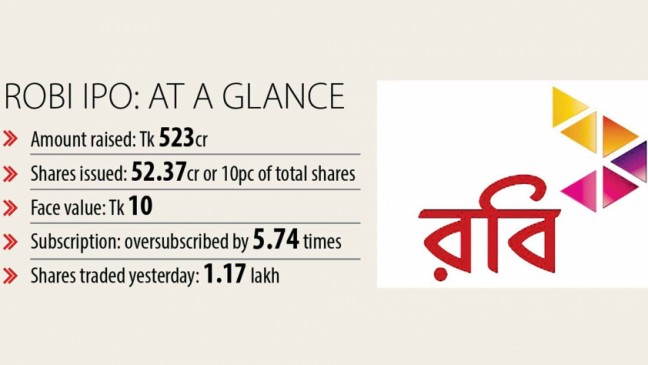

Robi rose 50 % to Tk 15 per share striking the circuit breaker against a good face benefit of Tk 10 each with less than one per cent or perhaps 1.17 lakh shares of the second biggest mobile operator being traded on the primary day.

Industry analysts said many key share holders were unwilling to market their Robi share on future targets of higher profits.

Investors are actually hoping Robi might perform better found in the coming days so those who got the shares through the original public offering (IPO) are actually holding on to it again, said Shahidul Islam, chief executive of VIPB Asset Control Company.

Most of them are waiting for the purchase price to increase or preferring to just retain some telecom shares, he said.

The business raised a fund of Tk 523.7 crore offloading 52.37 crore shares at Tk 10 each whereas another biggest IPO was that of its competitor GP's -- of Tk 486.1 crore.

Of the Robi's amount, around Tk 136 crore was raised from its staff members and the others from the currency markets.

The cellular phone operator's post-IPO earnings per share was Tk 0.22 for the time of January to September. Through the period, its profits stood at Tk 116 crore, shows the info of Dhaka STOCK MARKET (DSE).

Islam said investment in the stock market is determined by future leads of the business. So investors have a tendency to keep faith on the business regardless if its profitability background is poor, explained Islam, who manages around Tk 300 crore of mutual funds.

"Investors' expectation is not illogical because such a background does not imply that it will not be able to make revenue," he added.

Meanwhile, Beximco, Bangladesh Thai Aluminium, Bangladesh Submarine Cable Company and Shinepukur Ceramics built gains found in leading the DSE, the country's main bourse, to close the highest since August 25, 2019 when the index stood in 5,223.

The DSEX, the benchmark index of the DSE, rose 85 points, or 1.65 per cent to 5,218.36.

Institutional investors have already been buying stocks during the past few days, so stocks of companies with very good track records are soaring alongside the marketplace turnover, stated a stock broker.

Turnover, an essential indicator of the currency markets, rose to Tk 1,405 crore from Tk 1,244 crore in the previous working day. Yesterday's turnover was the best in four months.

Robi's inclusion on the market gave a good boost to investors' assurance, the share broker said, adding that banks had been earlier targeting to purchase the currency markets by availing a particular incentive of Bangladesh Lender.

The central bank announced previous February that banks were to create a fund of Tk 200 crore by firmly taking loans from it at less rate.

Yesterday, Beximco witnessed the most trade, worthy of Tk 96.73 crore, accompanied by IFIC Lender, Beximco Pharmaceuticals, LafargeHolcim Bangladesh and Bangladesh Submarine Wire Company.

Of the full total 360 companies to witness trade, 208 advanced, 74 declined and 78 remained unchanged.

Envoy Textile shed the most, losing 4.72 %, accompanied by Islami Insurance Bangladesh, Ability Grid Enterprise of Bangladesh, Aman Cotton Fibrous and Peoples INSURANCE PROVIDER.