Robi’s IPO subscription commences today

The biggest initial public offering in Bangladesh's history will make a major step forward today as investors can bid for the shares of Robi-Axiata.

The offer closes on November 23. Basic and eligible investors and non-resident Bangladeshis can apply for the shares.

Robi, the second-largest portable network operator, will probably increase Tk 523.79 crore from its IPO, overtaking industry head Grameenphone's floatation of Tk 486 crore in 2009 2009.

Just about all investors and analysts possess welcomed Robi's IPO given that they expect it to improve investor confidence. But over time, there might be a direct effect in the secondary market as the business is making available an enormous number of shares.

"We are thrilled by the IPO because of its growth potential," stated Mohammed Rahmat Pasha, ceo of UCB Capital Operations, a brokerage house.

"It's a dream IPO," he added

Usually, brokers usually do not show much interest in companies bearing lower earnings per share (EPS). However, Robi is different because it will correctly utilise the fund to improve profits.

"So, we wish the business's EPS will grow found in the approaching years along using its dividends," Pasha said.

Robi's EPS was Tk 0.04 in 2019.

Towards the end of October this season, the network company reached the milestone of five crore subscribers in a testament to its growing influence in the local market. Grameenphone has a lot more than 7.76 crore active members.

Robi was the primary operator to launch 3.5G services on Bangladesh. It rolled out 4.5G solutions around all 64 districts in 2018.

Since Robi is a multinational enterprise that maintains good governance, it will attract foreign investors, said Khairul Bashar Abu Taher Mohammed, ceo of MTB Capital, a merchant lender.

"The company's EPS is quite small, so investors will not get quick returns, but we hope it'll grow soon."

The market regulator should try to bring more multinational companies like Robi to the market to boost investor confidence, he added.

In a statement, Shahed Alam, chief corporate and regulatory officer of Robi Axiata, said: "In the event that you look at the global guidelines, digital companies aren't valued against their EPS."

"EBITDA [Earnings before interest, taxes, depreciation and amortisation] multiplier is employed as the yardstick. In this backdrop, it really is inappropriate to speculate on Robi's prospect predicated on our EPS."

Robi will issue 52.3 crore shares, which take into account 10 % of the company's final number of shares, at face benefit of Tk 10.

Originally, the operator will raise Tk 136 crore from the stock market by issuing 13.6 crore shares. The rest of the Tk 387.74 crore will be raised by doling out an additional 38.77 crore shares.

Of the 38.77 crore shares, around 19.39 crore will be issued to general investors and 15.44 crore to eligible investors. The others will head to non-resident Bangladeshi investors.

The IPO proceeds will be used to expand the business's network in anticipation of revenue-generating opportunities in the areas such as for example Internet-of-Things. IDLC Investments Ltd may be the issue supervisor of the IPO.

Robi is going to the public despite the fact that there continues to be no signs from the federal government that it could meet two conditions submit by the operator.

The operator demanded that the turnover tax be reduced to 0.75 % from the prevailing 2 % and the organization tax be slashed by 10 percentage points to 35 per cent for another 10 years.

Alam said Robi is paying an efficient tax level of 95 per cent.

"The minimum turnover taxes, high corporate tax amount and intensely high regulatory expenses get our financial position poorer than it really is. We anticipation with the rationalisation tax structure, Robi can register far better performance which it is capable of."

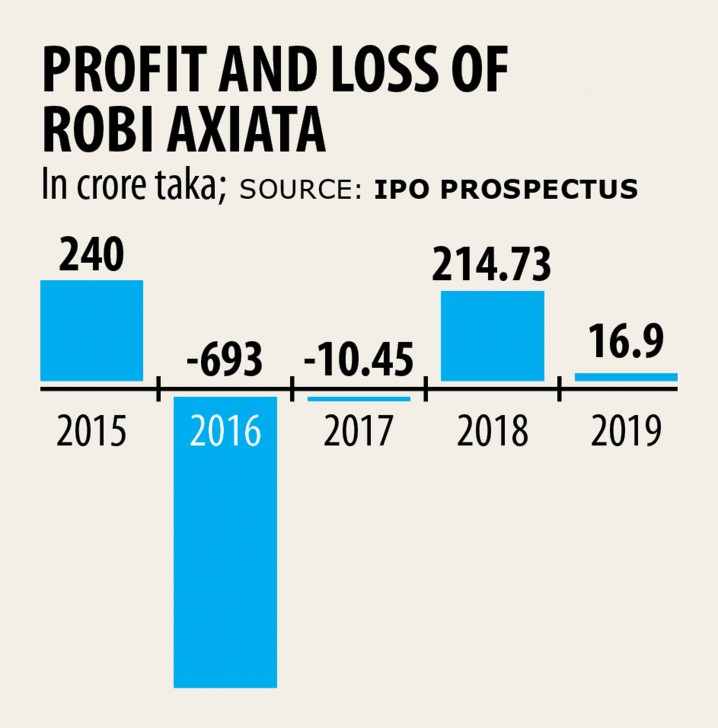

Regardless of the heavy tax burdens, Robi have been making earnings consistently for quite some time, he said.

"The merger [with Airtel] experienced put us in debt for quite a while, but we have successfully consolidated our industry position post-merger and so are seeking to deliver stellar performance in the coming days and nights leveraging our increased economies of scale."

The business had tried to get listed in 2015, nonetheless it backtracked because of "unfavourable business circumstances."

Its paid-up capital was Tk 4,714 crore and turnover Tk 7,481 crore in 2019, based on the draft prospectus.

The business's per share net asset value was Tk 12.64 by December 31, 2019.

The carrier started its journey in 1997 under the brand name of Aktel. After that it changed its brand to Axiata (Bangladesh) in 2009 2009 and took today's name Robi Axiata in 2010 2010.

Axiata holds a 68.69 % stake in the company and the Delhi-based Bharti Airtel owns the remaining 31.31 %.

In Bangladesh, Robi was the earliest operator to test 5G assistance on its network.

"The IPO is indeed huge that lots of investors have previously sold their shares in the secondary marketplace to use for Robi's offering," said a merchant banker.

"As our market turnover is still suprisingly low, its trade may impression the secondary industry," he added.