Revenue collection rises in Jul-Oct

The National Board of Revenue collected a 1.14 % higher tax of Tk 66,555 crore in the July-October period thanks to increased receipts from tax and import tariffs.

The overall collection was, however, Tk 20,445 crore short of the mark in the four months to October. The tax authority had targeted to sign in Tk 87,000 crore in revenue in the period, according to data shared by the NBR yesterday.

"Despite sluggishness in the economy amid the coronavirus pandemic, we've been able to accumulate higher revenue," said NBR Chairman Abu Hena Md Rahmatul Muneem at a press briefing at the NBR headquarters.

The tax collector organized the function to share the preparations it took to aid taxpayers to furnish income tax returns for the existing year at the field offices of tax as it is not holding the tax fair this year to reduce the risk of the spread of the viral disease.

Muneem said the NBR will not extend the tax return submission deadline, which is November 30. However, taxpayers can file returns within the next four months by securing a time extension from the tax offices following the expiry of the deadline.

The NBR said each tax zone made arrangements in a manner that appear to be tax fairs to facilitate taxpayers to file returns.

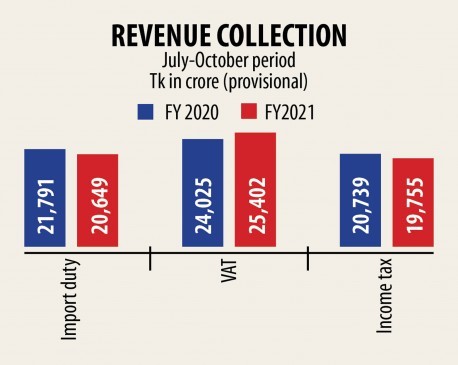

Provisional data prepared by the NBR showed that taxmen collected Tk 20,740 crore in the July-October period, up 5 % from a year ago.

Import tariff collection increased by 5.5 % year-on-year to Tk 21,790 crore. Collection of the biggest way to obtain revenue, value-added tax (VAT), declined 5 % to Tk 24,025 crore.

Muneem said you will find a huge potential of an assortment of VAT as a result of a wider scope provided in the VAT law.

However, the NBR can't take the entire advantage as the key transactions are not occurring through debit and bank cards.

He said the pilot phase of installing electronic fiscal devices at 100 shops in Dhaka and Chattogram became successful.

The earnings authority installed EFDs at 824 shops in two cities and a complete of 1 1,000 EFDs will be set up at shops and be operational by December.

At the briefing, Muneem also discussed the income collection from tech giants such as for example Facebook and the projects taken by the NBR to automate the earnings system.

He, replying to a question on High Court's recent directive to the NBR on the assortment of revenue, said collections from social media such as Facebook and YouTube aren't zero.

"We get earnings when the amount of money is transferred through the banking channel. If the amount of money is transferred through other channels, we can't track the payments," he said.

Meetings occurred among the ministries of commerce, ICT, telecommunication and information in recent time to handle the issue of earnings collection from the social media giants and e-commerce firms.

The NBR framed rules to ensure that the tech companies appoint agents or create a local office. In addition, it requested the telecommunication ministry to impose rules on the digital companies to open local offices or appoint agents in order that the NBR can track their incomes and expenditure.

On the failure of the automation schemes such as for example online submission of tax return, Muneem said the higher focus was presented with on procuring hardware and software without considering whether there are enough recruiting to perform the systems following the transfer of the ownership.

"Due to this fact, our dependence on foreign companies has increased for automation," he said.

"We are lagging in training our recruiting and recruitment. We want to focus on this area," he said.

The NBR is attempting to develop its IT set-up and to train its manpower so that the administration may take over the ownership of automation projects after completion.