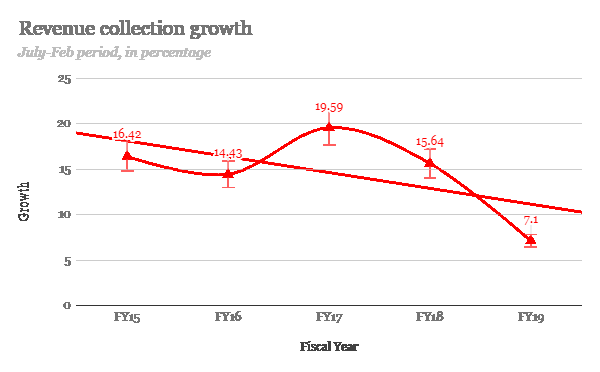

Growth slows to five-year low

Revenue collection growth slowed to 7 percent in the July-February period of the current fiscal year -- the lowest in five years -- owing to sluggish trend in receipts from VAT and customs tariff.

Between July last year and February this year, the National Board of Revenue (NBR) logged in Tk 133,460 crore, up 7 percent from a year earlier.

This means, the revenue authorities has set itself up for a herculean task in the remaining four months of the fiscal year if it wants get within a touching distance of the year's target of Tk 296,201 crore.

“It is a bad sign,” said Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh.

The Bangladesh Bureau of Statistics (BBS) has forecasted that the GDP will grow 8.13 percent this fiscal year, up from 7.86 percent last year.

Earlier this month, both the World Bank and the International Monetary Fund tipped the Bangladesh economy to log in the second-best growth figures in the world this calendar year and fiscal year.

“It was surprising to see that despite attaining the high economic growth, as estimated by the BBS, revenue mobilisation growth has decelerated,” said Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue (CPD).

It reflects two things: either the economy has not grown to the extent as estimated or the tax department is not performing well, said Mansur, a former economist of the IMF.

The manufacturing sector is expected to grow 19.28 percent this year, so the revenue collection from this segment should be high.

“Since that did not happen, it may be that the economy has not grown to that extent,” Mansur said, while calling for urgent reforms in the tax administration.

But revenue officials linked the slow growth in collections to the host of tax benefits given to various sectors, including liquefied natural gas import, telecom, the stockmarket and apparel exports. The expected amount of VAT also did not come from its biggest source: cigarette, they said.

During the July-February period, VAT collection increased 6.29 percent year-on-year to Tk 52,907 crore.

Income or direct tax receipts grew 12.13 percent from a year earlier to Tk 38,924 crore.

And despite higher import growth, collection from customs duty edged up 3.74 percent to Tk 41,629 crore.

“This is alarming. It appears that a section of importers are importing goods through mis-declaration to evade tax,” said a tax official requesting anonymity.

He went to place the blame on the lack of monitoring and enforcement at the field level.

The administrative capacity with regards to enforcing tax collection along with the culture of providing tax breaks on an ad hoc basis and without proper assessment of the impact are hindering revenue mobilisation, Khan said.

“The next budget should come up with a proper estimate of the revenue forgone due to various tax breaks.”

Implementation of planned reforms in the area of revenue mobilisation is a critical priority for the upcoming budget, Khan said.

“One may expect a major shortfall in revenue mobilisation target. Formulation of the revised budget should take this into cognisance while setting the revenue targets for next year.”