Revenue shortfall can’t give up stretching

Revenue shortfall against the mark, which is a basic occurrence nowadays, is getting wider seeing that the fiscal yr nears its end, very much to the concern for the federal government which has already ramped up its borrowing from the banking sector.

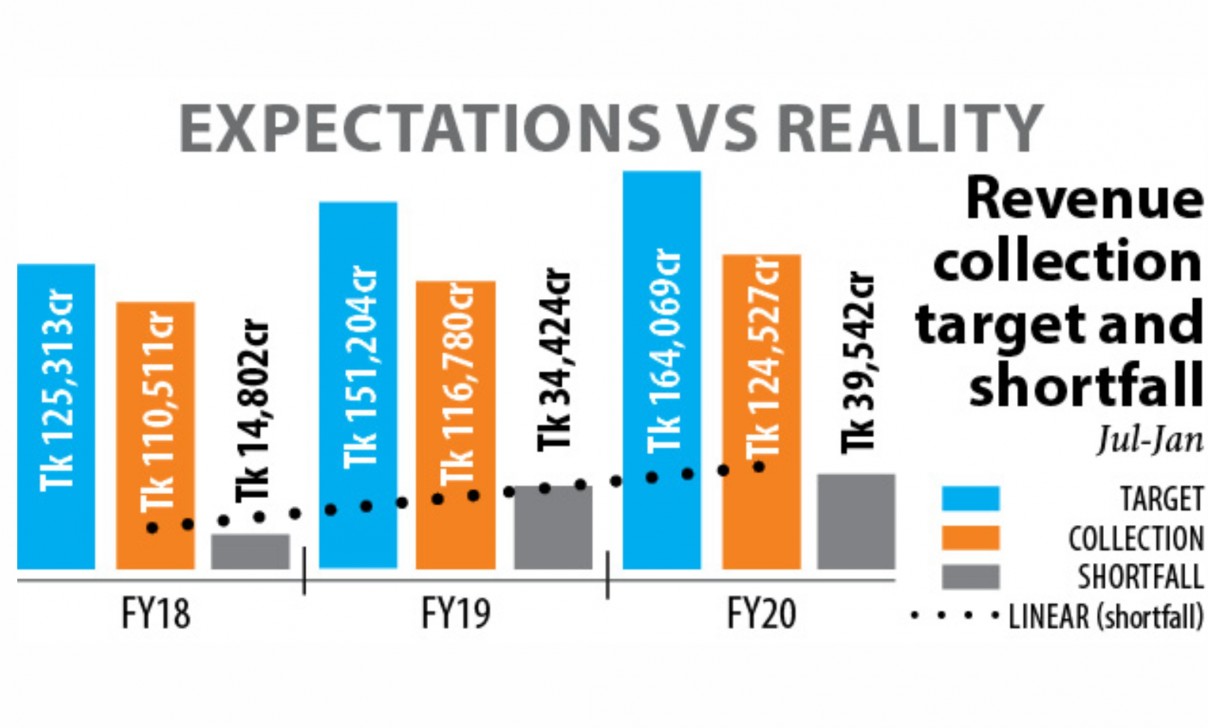

Provisional data showed the National Board of Income (NBR) could sign in Tk 124,500 crore in the primary seven months of the fiscal year, lacking the prospective by Tk 39,500 crore for the period.

This suggests the government will have to either increase its borrowing from the banking sector or cut back on its expenditure plans for the fiscal year.

In the initial half of fiscal 2019-20, the federal government borrowed Tk 49,000 crore, which is 63 per cent of the year's target. Of the sum, Tk 43,600 crore from banks, which is definitely eight times greater than a year earlier.

The NBR, the primary collector, fell short of Tk 31,500 crore from its revenue goal in the first half of fiscal 2019-20.

And the target may very well be missed by more than Tk 80,000 crore, according to Ahsan H Mansur, executive director of Plan Research Institute (PRI) of Bangladesh.

The quantity of shortfall remained lower in past years, but the gap from target risen to a lot more than Tk 50,000 crore last fiscal year.

"The existing pace of revenue generation is hurting budget implementation this fiscal 12 months," said Towfiqul Islam Khan, senior analysis fellow of Center for Coverage Dialogue (CPD). Bangladesh's fiscal discipline is now at risk.

"There is a have to make an honest evaluation regarding the reasons behind this small growth. Surely, there is a scope for bettering administrative capacity," Khan added.

During the July-January amount of the fiscal season, the NBR recorded 7 % year-on-year growth, according to its provisional info.

The indirect tax, value-added tax (VAT) paid by consumers, may be the biggest source of earnings and the NBR collected 5 % higher VAT through the period than a year earlier: Tk 48,400 crore.

"Receipts from VAT might upsurge in the final count," said a good senior official of the NBR asking not to be named as he's not authorised to consult with the media.

Implementation of the brand new VAT and SD Take action definitely did not translate into higher earnings mobilisation, Khan said.

"Awarding taxes exemption on an random basis in the brand of expansion stimulation is currently hurting. At the same time, we need to have a closer consider the performance of the entire economy," he added.

Apart from VAT, the assortment of income tax, the next biggest earnings source, increased 15 % year-on-year to Tk 38,960 crore on the seven a few months to January.

Customs officials could content only 1 1 per cent higher assortment of Tk 37,000 crore because of declining machinery, petroleum and motorcycle imports.

"There is definitely more challenging times ahead when it comes to earnings mobilisation," Khan said.

Uncertainty found in the global economy in view of coronavirus will not indicate any swift recovery.

"The government should be proactive. There is a need for early revision of the national budget," Khan added.

Revenue collection growth will continue to remain sluggish if the NBR runs business-as-typical, said Mansur, also a good former economist at the International Monetary Fund.

"You won't be possible to boost from the existing situation without a significant reform found in the NBR's system."

He blamed corruption and less than- and over-invoicing of imported things as a number of the major reasons for the sluggish income flow.

Besides, the revenue collection target set by the government is unrealistic.

The government has set a target of Tk 325,600 crore for the NBR this season, up 45 % from fiscal 2018-19's actual collections.

"Even after that, income collection could grow 25-30 % year-on-year if the government truly earns reforms found in the NBR. If so, the tax-to-GDP ratio would have increased," he added.

Bangladesh's tax-to-GDP ratio, which is approximately 10 %, is amongst the cheapest in the world.