Money whitening may get full amnesty

The federal government may grant full amnesty to the persons if indeed they invest their untaxed money, generally known as black money, since it looks to provide a boost to the economy reeling from the coronavirus pandemic.

Black money is basically related to tax evasion and its own direct impact is the loss of government revenue.

Going back five years, black money-holders have already been in a position to whiten their assets by investing in residential buildings by paying a tax of 10 per cent on the total amount invested, which for regular taxpayers is between 10 and 30 per cent.

But the Anti-Corruption Commission (ACC) gets the power to raise questions about the foundation of the funds.

But the government is currently researching to give full amnesty as the instrument has failed to achieve its objectives of raising income for the federal government while inducing investments, said the official of the finance ministry.

The government could also cut the corporate tax for the non-listed companies by 2.5 percentage points to 32.5 % to provide some breathing space to the firms after their procedures were seriously influenced by the shutdown and sales collapsed.

The government may improve the tax-free income limit for individual taxpayers after five years in fiscal 2020-21 to provide relief to people in the lower-income bracket in a way that they are able to manage the economical hardship brought on by the pandemic better.

The tax-free income tax threshold may rise to Tk 3 lakh from Tk 2.5 lakh.

The tax slabs could be rearranged as well. The rates of tax now stand at 10 per cent to 30 per cent but it might be cut to 5 per cent to 25 per cent within the next fiscal year.

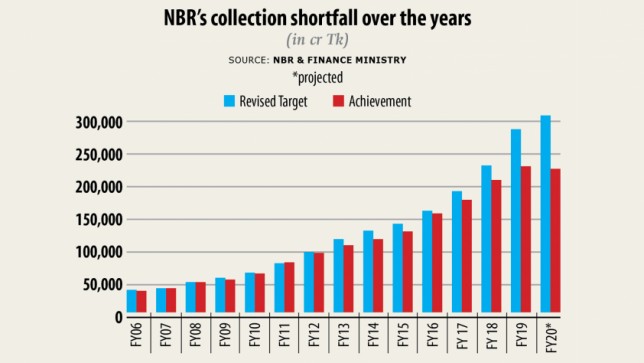

Meanwhile, the federal government has responded positively to a National Board of Revenue (NBR) plea and set less target for fiscal 2020-21.

The massive plunge in earnings collection prompted the NBR to request the federal government to set an authentic target for another fiscal year.

Now, the government may set a revenue mobilisation goal of Tk 301,000 crore for the upcoming fiscal year, down from Tk 330,000 crore in the beginning planned, said the state of the finance ministry.

The NBR is likely to log about Tk 220,000 crore in the ongoing fiscal year, leaving the best ever shortfall ever sold largely due to the massive fall in tax receipts due to the pandemic and consequent stoppage of monetary activities.

The collection, as projected by the NBR, would also fall below last year's total tax assortment of Tk 223,892 crore, within an unprecedented development.

"This is the first-time since Independence that the collection is below the previous year's total," said NBR Chairman Abu Hena Md Rahmatul Muneem in a letter to Finance Secretary Abdur Rouf Talukder last month.

The collection wouldn't normally be more than Tk 250,000 crore within the next fiscal year, the NBR said.

As the collection will decline and be far below compared to the target in fiscal 2019-20, this might be the ninth consecutive year that the NBR would miss both actual and revised collection goals set by the federal government to finance its overall fiscal plans.

The revised collection target of Tk 300,500 crore would be impossible to do this fiscal year as the result of the coronavirus-induced lockdown on domestic and external demand, businesses and incomes prolonged, Muneem has said.

The projection comes at the same time when the NBR posted just a little over 1 per cent growth in tax collection at Tk 175,000 crore in the first ten months of the fiscal year.

And the slowing collection was the result of negative growth in April, the first month of the shutdown and stay-at-home order enforced by the federal government to flatten the curve on the deadly virus.

Revenue collection crashed a lot more than 55 per cent in April, revealing the massive hit the Bangladesh economy has taken from the coronavirus outbreak in the country.

"Realistic income mobilisation targets will be crucial for overall fiscal management," said the Centre for Policy Dialogue (CPD) in a press briefing yesterday.

The economic slowdown originating from the nationwide lockdown and the adverse impacts of the pandemic on international trade are expected to further exacerbate the problem during the remaining fiscal year.

"There is no beacon of hope regarding earnings mobilisation in fiscal 2019-20. The income shortfall is likely to shoot up," the CPD said in its review on the economy.

The think-tank revised upward its forecast on overall tax and non-tax revenue shortfall to Tk 125,000 crore because of this fiscal year, up from Tk 100,000 crore earlier.

"This implies, the earnings earnings in fiscal 2019-20 will probably record a minuscule growth of 0.4 %," it said.

Because of this, the revenue-GDP ratio may see a decline in fiscal 2019-20, from 9.9 % in fiscal 2018-19.

If the earnings mobilisation targets aren't set realistically , nor reflect the reality of the situation, it'll put undue strain on the earnings collection authorities, stress the fiscal framework beyond a tolerable limit and undermine the efficacy of other relevant policy instruments, the CPD said.

"This will weaken the fiscal framework, bring about misinterpretation of fiscal deficit and therefore placed into question the veracity of financing of the fiscal deficit."

The cover fiscal 2020-21 must provide a detailed explanation as to how the programmed revenue mobilisation targets will be performed through the proposed fiscal measures, the CPD said.

A minimum revenue lack of 2 % of GDP, or $6.7 billion, is projected by the federal government this fiscal year.

"Even if the situation improves, you will have a negative influence on revenue collection due to the long-term influence on the economy," Muneem said.