Mobile carriers look and feel hard done by

The government might not exactly achieve their target revenue from the telecom industry with only a 5 % upsurge in supplementary duty for the upcoming fiscal year, said senior executives of the country's mobile network providers yesterday.

Through the budget proposal carry on Thursday, Financing Minister AHM Mustafa Kamal released a 15 per cent supplementary duty upon telecommunication services, a substantial rise from the prior 10 %. This decision came into effect on Friday.

Every year, the taxes are increased in a variety of ways because it is easy to gather revenue from the telecom industry, said Taimur Rahman, chief corporate and regulatory affairs officer of Banglalink.

"The authorities consider the telecom industry to become a cash cow. That is why investors shy from Bangladesh but jump in wholeheartedly in other markets," he added.

The brand new supplementary duty rate could supply the government an additional Tk 300 crore nonetheless it would also damage the industry, said Shahed Alam, chief corporate and regulatory officer of Robi, during a digital press conference organised by the Association of Mobile Telecom Operators of Bangladesh (AMTOB).

The government expects to collect an additional Tk 1,008 crore through this 5 % increase. However, this approach is only going to reduce their expected earnings by Tk 700 crore, he said.

The telecom industry considers the tax burden as a significant obstruction for growth and this will hinder Bangladesh's journey to become a digital economy, Alam added.

With this backdrop, the AMTOB has asked the federal government to review the new tax as the telecom sector has been declared as an essential service.

To handle their concerns, AMTOB General Secretary SM Farhad said that the organisation currently contacted Telecom Minister Mustafa Jabbar, who expressed frustration more than the budget and assured that the Prime Minister's ICT Affairs Adviser, Sajeeb Wazed, was first informed on the problem.

Presently, the telecom industry makes up about about 7 % of Bangladesh's economy.

If the telecom companies get a more favourable organization environment, then it can help the industry contribute up to 10 per cent of the economy within an extremely short time.

"But this is simply not the case. Rather, the sector has discovered a new challenge in running standard operations."

In terms of the client to earnings ratio, Bangladesh's telecom sector is in the lowest position.

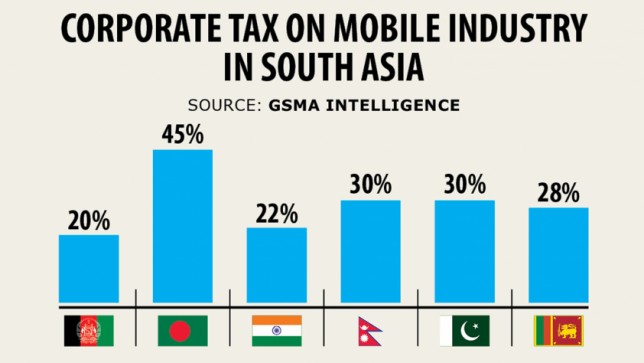

In terms of taxes, however, Bangladesh's mobile network providers pay the best tax amongst their counterparts in different South Asian countries.

"This imbalance cannot continue for a lot longer," Farhad added.

Besides, the country's existing tax policies aren't business-friendly for probable investors of the sector.

This directly contradicts the government's vision for a 'digital Bangladesh' and the burden finally falls on consumers.

In fiscal 2014-15, taxes levied on the telecom industry amounted to only 15 per cent tax. Since then, however, that value has ballooned to 33.25 %.

Following the latest hike in supplementary duty, if any client recharges Tk 100, they will hardly get a talk-period value of Tk 75.05 as the staying sum will go directly to the exchequer directly.

Mobile network providers curently have to pay the government about Tk 51 to Tk 57 per Tk 100 sale due to all of the taxes and income sharing and this is only going to rise because of the new duty.

Echoing the sentiment, Hossain Sadat, director and head of people and regulatory affairs of Grameenphone, urged the federal government to withdraw the brand new supplementary duty.

As of March, there were 16.53 crore active mobile connections in the united states. Of these, 9.52 crore are linked to the internet, according to the Bangladesh Telecommunication Regulatory Commission.

Annual revenue from the market currently stands at around Tk 25,000 crore.

Apart from this tax, it was also recommended found in the proposed spending budget to improve VAT from 30 per cent to 50 per cent. This ensures that if any dispute arises, carriers must pay 50 % of the earnings regulator's claim to obtain a settlement.

"We will be seeing it as a regulator ensuring its revenue, not justice," explained Alam from Robi.

Meanwhile, Farhad said that corporate tax in telecom and tobacco products may be the same at 45 % while the minimum tax rate in tobacco is less.

For minimum tax, tobacco producers pay 1 per cent of their total revenue, which will remain the same in the year ahead while network providers will pay 2 per cent.

"May this indicate that telecom products and services certainly are a bigger health hazard than tobacco?" Farhad said.