MCCI demands cutting land registration fees

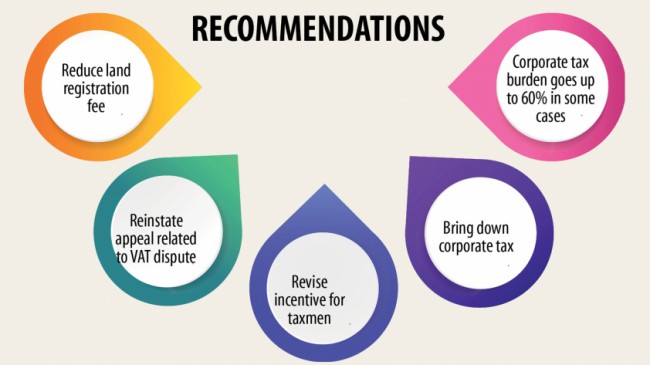

The Metropolitan Chamber of Commerce and Industry (MCCI) yesterday urged the government for reducing land registration fees, stating that the current land registration system promotes scopes for the generation of illegitimate money.

The government-fixed land price rates are lower than what actually prevailed on the ground, said the leading chamber.

As a result, whenever a seller transfers land, the prices illegal shown in line with the lower government rates rather than at that which was actually paid. This attempt at avoiding paying higher registration service fees turns illegal some of the amount of money earned by the seller.

"If the registration service fees are reduced through consultation with stakeholders, there will be no shortage of revenue," said MCCI President Nihad Kabir.

"Economy will have legally earned incomes and earnings management will be transparent," she said putting proposals for tax measures for fiscal 2021-22 at the National Board of Revenue (NBR).

NBR Chairman Abu Hena Md Rahmatul Muneem chaired the function.

In its recommendations, the MCCI, members which account for nearly 40 % of the state's total tax collection, said the national cover another fiscal was very important.

The government's support for businesses is necessary for recovery from the Covid-19 induced uncertainty, according to a press release.

The next budget can be important from the perspective of Bangladesh making the US status graduation to a developing country from least developed one by 2026.

"We have always been emphasising on making budget management dynamic. The MCCI believes that businesses can pay spontaneously if budget management is transparent and dynamic," said Kabir.

The MCCI lauded the government for reducing tax rates for publicly non-listed companies to 32.5 per cent from 35 %.

"However, the effective tax rates are higher," said Kabir, adding that taxes rise to 50-60 % occasionally when import duty on intermediate goods and finished products are taken into account.

"That is affecting business seriously and discouraging foreign investment," she said.

The trade body also demanded the revenue authority reinstate an appeal process of settling value added tax (VAT) related disputes between companies and field offices of the earnings authority.

It said introduction of something of revision for VAT to resolve disputes had not been yielding appropriate results.

The MCCI also demanded that the NBR reconsider the incentives directed at the taxmen for increasing the assortment of taxes.

It said regulations provides for incentive for those taxmen who can gather higher levels of taxes. As a result of this, an uneven competition sometimes appears among official that businesses suffer, said the MCCI.

"So we appeal for reconsideration of the machine," it said.