Loan write-offs balloon in Q2

Loans written off by banks soared in the second quarter of 2018 as efforts to clean up balance sheets petered out.

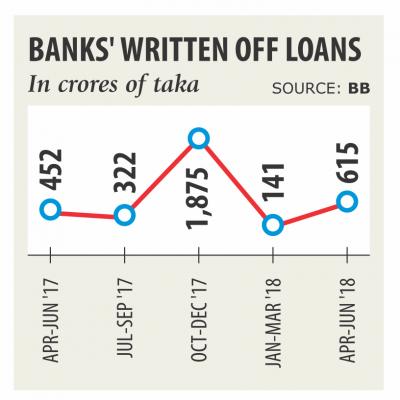

Between the months of April and June, the amount of loans written off by lenders stood at Tk 615 crore, an increase of 4.36 times from three months earlier.

The amount took the tally of written-off loans since January 2003, when the policy was introduced, to Tk 48,890 crore, according to data from the central bank.

Some 14 banks wrote off their bad loans in the second quarter, with the highest figure registered by Dutch-Bangla Bank Ltd (DBBL). DBBL removed bad loans amounting to Tk 172 crore from its balance sheet during the period, followed by Eastern Bank at Tk 111 crore, Prime Bank at Tk 102 crore and IFIC Bank at Tk 89 crore.

Some banks scrambled to write off their bad loans in the second quarter to keep their default loans artificially low, said a Bangladesh Bank official.

But the move will not bring any positive impact to the banking sector as there is next to no possibility of recovering such category of loans, he said.

State-run banks wrote off only Tk 1.26 crore and private banks Tk 599.19 crore during the quarter.

Two specialised banks, however, did not go for any write-offs during the period.

Most of the state-run banks have skipped out on writing off their bad loans as they did not have the cash needed to keep provisioning against them, the central bank official said.

The banks are already burdened with huge provisioning shortfall, for which they often took support from the central bank.

For instance, Sonali Bank is yet to write off the entire loans of Hall-Mark Group although the lender had categorised the controversial group's loans as bad in 2013.

As per the banking norms, there is no scope of taking deferral support when lenders write off loans.

Banks have to file lawsuits against the defaulters with the court before writing off the loans, according to the rules.

Between January 2003 and March 2018, Tk 48,890 crore was written off. Of the amount, 76 percent remained outstanding, meaning banks' efforts to recover the bad loans have not paid off. The rising trend of loan write-offs reflects the indiscipline reigning in the country's banking sector, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

“Lenders opt for write-offs when the defaulted loans rise significantly. It is an attempt taken by banks to prevent people from knowing their actual financial health.” The written-off loans are legally recoverable but banks usually do not take initiatives to realise them -- a major ailment of the banking sector, Khaled said.

During the April-June quarter, default loans rose by Tk 15,037 crore to Tk 89,340 crore, according to data from the BB.

Default and write-off loans together amounted to more than Tk 1.26 lakh crore at the end of June. AB Mirza Azizul Islam, a former caretaker government adviser, echoed Khaled. He underscored the need for prompt action to recover the written-off loans by settling the cases filed by banks with money loan courts.