Listed apparel manufacturers bleed for pandemic-induced demand collapse

The profits of almost all of the outlined apparel companies tumbled in the July-September quarter as a result of collapse popular abroad amid the coronavirus pandemic.

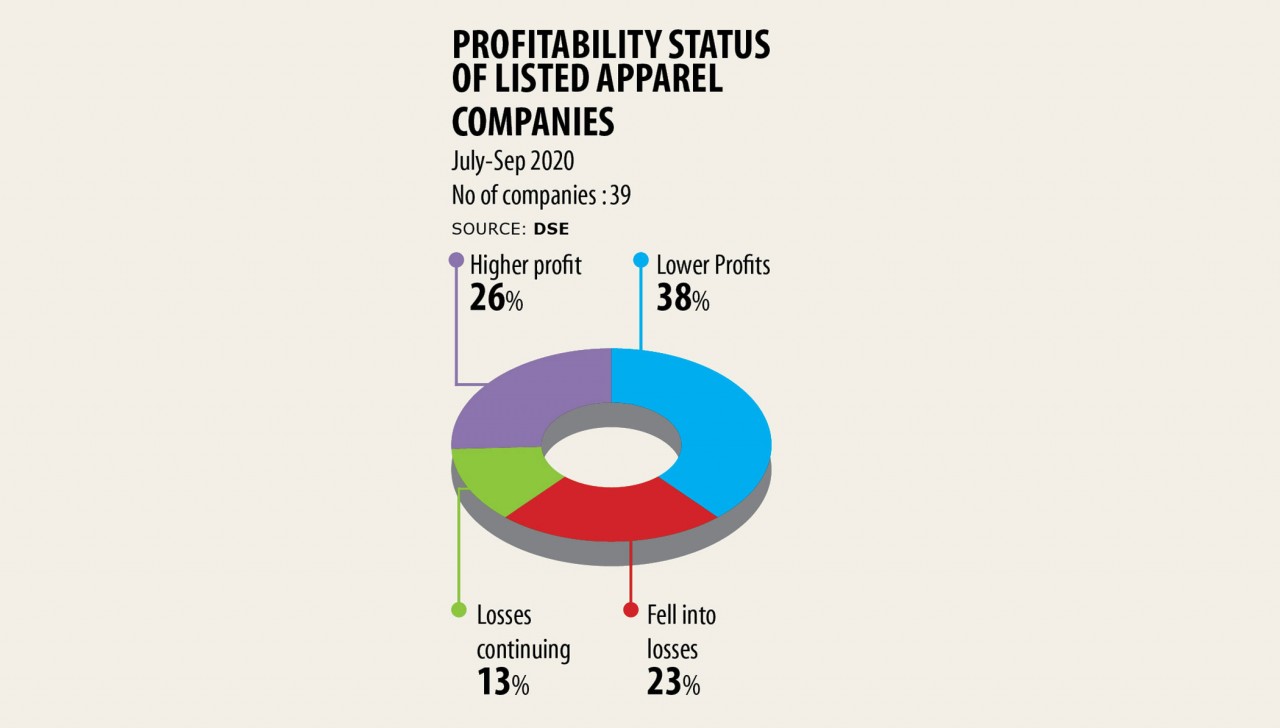

Among the 56 textile and garment companies shown on the Dhaka Stock Exchange (DSE), 39 companies released their first quarterly fiscal reports. Of these, 15 posted profits which were less than in the same period a year ago.

Nine corporations returned to red after making money found in the same period this past year. Five corporations extended their battle to return to profits.

"The apparel industry witnessed lower earnings due to a drop on sales inside our export destinations amid the pandemic," said Anwar-Ul-Alam Chowdhury, chairman of Evince Textile.

"In the height of the pandemic, our export orders have been cancelled, keep, or revised," he explained.

He said the woven sector received the major blow while people did not head to offices or have been working at home and limited going to social gatherings and parties. So, the demand for formal shirts and apparel products offers dropped.

In the July-September quarter, the export earnings of the woven sector declined by 5.78 per cent year-on-year to $3.88 billion, data from the Export Promotion Bureau showed.

Of the full total earnings from the garment sector, $4.46 billion originated from knitwear shipment, which rose 7.04 %.

"The overall situation won't improve until the pandemic goes," said Chowdhury, also a former president of the Bangladesh Garment Manufacturer and Exporters Association.

Evince Textile's earnings per share stood at Tk 0.32 found in the negative in the first quarter. It had been Tk 0.19 in the same period last year.

Various retailers thought they might do good business during Christmas, the biggest spending season under western culture, but it might not happen because of the next wave, he added.

After the lower profit disclosure by the apparel sector, the stocks of the industry fell on the DSE. Of the organizations, the cost of 11 companies rose, 22 declined, and 23 remained unchanged yesterday.

The marketplace capitalisation of the textile sector was Tk 10,477 crore yesterday, or about 3.20 % of the total marketplace capitalisation of the DSE. It had been 3.75 % on July 1.

"Our textile sector is principally related to international trade, however the growth of the export earnings through the period had not been encouraging because of the pandemic. We recognized that their earnings wouldn't normally delight us," said Mir Ariful Islam, mind of research of Prime Financing Asset Management Company.

"But the textile sector had performed worse than our analysis. Our export earnings didn't see de-growth in the quarter," he said.

Between July and September, the shipment of apparels, which typically contribute 84 % to the national export, grew 0.84 % year-on-year to $8.12 billion.

Among the listed textile firms, 14 apparel companies, or 25 per cent of the sector, incurred loss in the quarter, the best ratio among all of the industries, an analysis of DSE data showed.

Safko Spinning was the biggest loser: its EPS was Tk 2.09 in the negative in the quarter, higher from Tk 1.62 in the negative found in the first quarter of 2019-20.

Evince Textile, Generation Next, Hamid Fabrics, Nurani Dyeing, Prime Textile, Shepherd Industries, Sonargaon Textile, Stylecraft and Zaheen Spinning Mills incurred loss in the July-September quarter. They all were in profits in the same period in 2019.

Prime Textile and Sonargaon Textile witnessed the highest deviation within their earnings. EPS of Prime Textile was Tk 0.12 found in the first quarter of the previous financial year, but it declined to Tk 0.96 in the negative found in the first quarter this season.

Paramount Textile booked the highest EPS among all of the listed textile and garment companies. Its earnings per share were Tk 1.51 within the last quarter, up from Tk 1.23 this past year.

"The wages of the apparel sector fell mainly due to the lower orders from the international market," stated Mustafa Kamal, chief fiscal officer of Argon Denim.

Argon's turnover dropped to Tk 65 crore in the first one fourth from Tk 91 crore in the same one fourth in the last year.

As the majority of the European economies had enforced lockdowns to limit the spread of the virus, the sector in Bangladesh struggled, he said, adding that the industry had started feeling the heat from April.

The order has begun to go up of late, but the revival may well not last as some countries, including the UK, Spain and France have previously reintroduced lockdowns amid a surge in infections, he added.