Stocks nosedive for third straight day

Stocks in the premier bourse witnessed a drop for the third consecutive day carrying out a steady rise for over weekly.

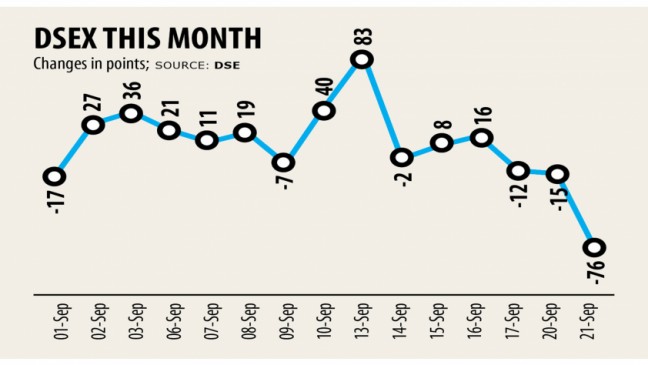

DSEX, the benchmark index of the Dhaka STOCK MARKET, shed 76 points, or 1.50 %, yesterday to stand at 5,012.12.

"But corrections will be the beauty of an excellent currency markets," according to a merchant banker.

The index underwent corrections within the last few days, not long following the market had increased to a sustainable position, he said.

DSEX rose by 152 points during September 10-16 but dropped 103 points within the last three days, according to DSE data.

When the market declines, it offers certain people the opportunity to invest more money and for that reason should be seen as an investment opportunity, the merchant banker added.

The marketplace is on the right path but a few junk stocks are overvalued, so the investors ought to be careful, according to a stock broker.

If an investor falls in hot water and incurs losses after buying junk stocks, then it'll negatively impact the market, he said, adding that the regulator should be wary of this and give attention to promoting companies that succeed.

Turnover, a significant indicator for the market, dropped 11 per cent to Tk 977.58 crore yesterday at the Dhaka bourse.

Of the total 355 traded stocks, 82 advanced, 259 declined and 14 were unchanged, according to DSE data.

The DSE's turnover list was topped by DBH, which traded shares worth Tk 26.63 crore, accompanied by Beximco, Rupali Insurance, Beximco Pharmaceuticals, and Purabi General Insurance.

ICB Employees Mutual Fund topped the gainers' list with a 10 per cent increase followed by SEML IBBL Fund, ICB Third NRB, VAML Fund, and Miracle Industries.

Provati Insurance shed the most, plunging 10 per cent accompanied by Peoples Insurance, Republic Insurance, Agrani Insurance and Shyampur Sugar Mills.

The Chattogram bourse also witnessed a reduction in its benchmark index.

The CSCX, the benchmark index of the Chittagong STOCK MARKET, dropped 126 points, or 1.44 %, to 8,597.43.

Of the full total 286 stocks, 85 rose, 184 fell and 17 remained unchanged.