Stocks nosedive to three and a half-years low

Dhaka stocks suffered a huge fall yesterday as skittish foreign investors went for selloffs fearing currency devaluation amid policy uncertainty and year-end portfolio adjustments by banks, sending the key index to its three-and-a-half year low.

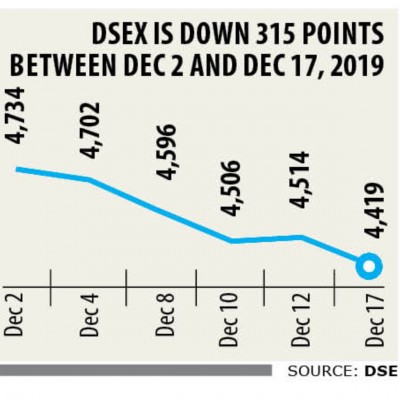

The benchmark -- the DSEX -- dipped 78.66 points, or 1.74 percent, to close the day at 4,419.82. In the last two days, the market lost Tk 18,928 crore from its market capitalisation.

Analysts say foreign investors are selling more shares than they purchase because of the fear that the local currency might be devalued, while some banks and non-banks sold shares to adjust their portfolios as 2019 is approaching its end.

General and institutional investors are also not investing due to a lack of confidence in the market.

“Forced sale execution is one of the main reasons for the recent fall,” said Khairul Bashar Abu Taher Mohammed, chief executive officer of MTB Capital, a merchant bank.

If the securities bought with margin loans decrease past a certain point, lenders can legally force the investors to sell some of their assets to save the fund lent.

Bashar, also the general secretary of the Bangladesh Merchant Bankers Association, said many brokers and merchant banks hadn’t executed forced sales in recent times in the hope that the market would make a turnaround. But, they have had to change their mind as the index is falling every day, he said, adding that fresh investment is not coming to the market owing to a lack of confidence amid the liquidity crunch in the banking sector.

Ali Xahangir, chief executive officer of amarstock.com, a website that provides technical analysis on market movements, said the initial public offering of Ring Shine Textiles worth Tk 150 crore supplied more shares to the bearish market.

The regulator should have had an analysis on whether the market was ready to absorb such a big IPO in a downward market, he said.

Ring Shine Textiles made its debut on December 12.

An asset manager says the market is suffering from a huge confidence crisis because investors can’t fathom how far the market would fall and when it may start to rise.

Those who have liquid money are also not investing, he said. Moreover, some banks and non-bank financial institutions are adjusting their portfolios.

Banks and NBFIs maintain accounts in line with the calendar year running from January to December, instead of July to June followed by other companies.

A stock broker, who deals with foreign investors, says foreign investors’ confidence has also been spooked by policy changes.

He said the tenure extension of closed-end mutual funds and the National Board of Revenue’s sudden claim of Tk 12,579 crore from Grameenphone, the largest listed company in Bangladesh, have affected the confidence level of international investors.

Turnover, another important indicator of the market, fell 8.12 percent to Tk 281.56 crore.

Ring Shine Textiles topped the turnover list with its shares worth Tk 15.68 crore traded, followed by Beacon Pharmaceuticals, Square Pharmaceuticals, Standard Ceramics, and Brac Bank. Of the traded issues, 35 advanced, 278 dropped, and 40 remained unchanged.

Chittagong stocks also fell, with the bourse’s benchmark index, the CSCX, declining 144.63 points, or 1.70 percent, to finish the day at 8,151.43. Losers beat gainers as 173 securities declined, 35 advanced and 22 finished unchanged on the Chittagong Stock Exchange.

The port city bourse traded shares and mutual fund units amounting to Tk 14.63 crore.