Lender directors’ demand for extending mortgage repayment tenure faces criticism

Directors of banks experience urged the central lender to relax the repayment tenure for term loans and performing capital further, a good demand that was first opposed by bankers and analysts seeing as the banking industry continues to be reeling from the pandemic-induced slowdown.

The banking sector has been around a bad state of affairs for the last year or two and the ongoing business slowdown caused by the coronavirus pandemic possesses exacerbated the situation.

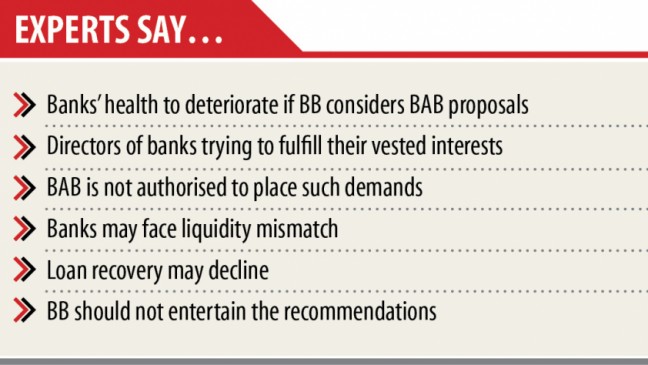

Against the background, the central bank shouldn't entertain the proposal of the Bangladesh Association of Banks (BAB), an organisation of directors of private banks, in the interest of the banking industry, specialists said.

The BAB wrote a letter to the central lender governor on February 4, requesting him to extend the prevailing relaxed repayment tenure by 2-3 years for term loans.

Credits that carry a repayment tenure of more than one year are considered term loans.

The central bank eased the repayment facility for term loans on January 31 to help them pay instalments relaxed as the pandemic persists.

The mortgage loan moratorium facility granted to all or any types of borrowers throughout last year was not extended.

The instalments of the term loans which were scheduled to be paid this past year will be added to the main amount of borrowers. This may create trouble for debtors as the instalment size are certain to get bigger, prompting the central bank to create the latest move.

The BAB also requested the BB to reschedule working capital and demand loans by stretching the repayment tenure to 3 years from the existing twelve months.

Furthermore, the central bank has been requested to ask banks never to take any deposit while rescheduling the functioning capital.

Banks usually take down payment spanning from 15 % to 30 % so that you can regularise performing capital and demand loans.

A demand mortgage loan is a borrowing device that allows loan providers to recall the mortgage loan on a brief notice. Once notified, borrowers must repay the entire amount of the mortgage and any associated fascination.

This arrangement also allows the borrower to repay the loan anytime without an early repayment penalty.

Working capital is going to be another short-term mortgage that banks give out to borrowers to operate their organization. The repayment tenure of both doing work capital and demand loans is normally no more than one year.

The Daily Superstar talked to the controlling directors of four banks about the BAB's proposal. All of them highly opposed the BAB thought as the financial wellbeing of banks will deteriorate if the central lender accepts the proposal.

If banking institutions are forced to convert demand and working capital loans into term loans, you will see a liquidity mismatch in the banking industry, the MDs said.

Up to 70 per cent of the full total outstanding loans amounting to Tk 1,011,829 crore were term loans by December last year, according to a BB official.

The existing surplus liquidity won't last forever as banks will face a probable fund shortage when the economical recovery picks up.

"The money flow of banking institutions will nosedive if performing capital and demand loans are converted into term loans," explained one of the MDs.

Some 25.24 % of the outstanding loans in the banking sector enjoyed the central bank's moratorium support.

This means a majority of clients possessed paid instalments regardless of the business slowdown, the MD said.

"So, as to why will the central lender relax the repayment tenure? The BAB proposal is totally illogical and will go against the fascination of the banking market," he said.

Directors of banks want to fulfill their vested pursuits as many of their enterprises are actually in dire straits as a result of their ill practices found in operating businesses, he said.

For instance, they took loans worth Tk 171,666 crore by September 2019, which is around 18 % of the total remarkable loans in the banking sector.

A great number of directors may become defaulters if they neglect to manage the facilities.

The Association of Bankers, Bangladesh, a forum of managing directors of banks, earlier welcomed the central bank that allowed borrowers to repay loans by extending the repayment tenure by two years.

But, the BAB proposals possess contradicted the ABB's stance, the MD said.

Defaulted loans, which reduced last year, may rise in the days forward as the central bank lifted moratorium.

Non-doing loans (NPLs) stood at Tk 94,440 crore by September this past year, down 1.74 per cent from three months earlier and 18.73 % year-on-year, info from the Bangladesh Bank showed.

Salehuddin Ahmed, a former governor of the central lender, said that the BAB had not been authorised to submit such proposals to the central lender as there had been a conflict of fascination.

"Directors are not permitted to be engaged in the procedure of banks. But the proposals have provided a clear indication they are engaged in the daily operations of banks, breaching guidelines," he said.

The central bank should strictly oppose the BAB recommendations, Ahmed said. If required, the central bank can stay with the ABB to have a decision to the end, he said.

Business chambers are likely to raise such demands, so it is very illogical for the BAB to submit the proposals, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

Ahsan H Mansur, executive director of the Insurance plan Exploration Institute of Bangladesh, said that the central lender shouldn't issue any notice predicated on the BAB recommendations.

"Some borrowers who've taken working capital might face issues in the days ahead. Hence, the central bank may think of the problem positively. But, this issue shouldn't be generalised," he said.