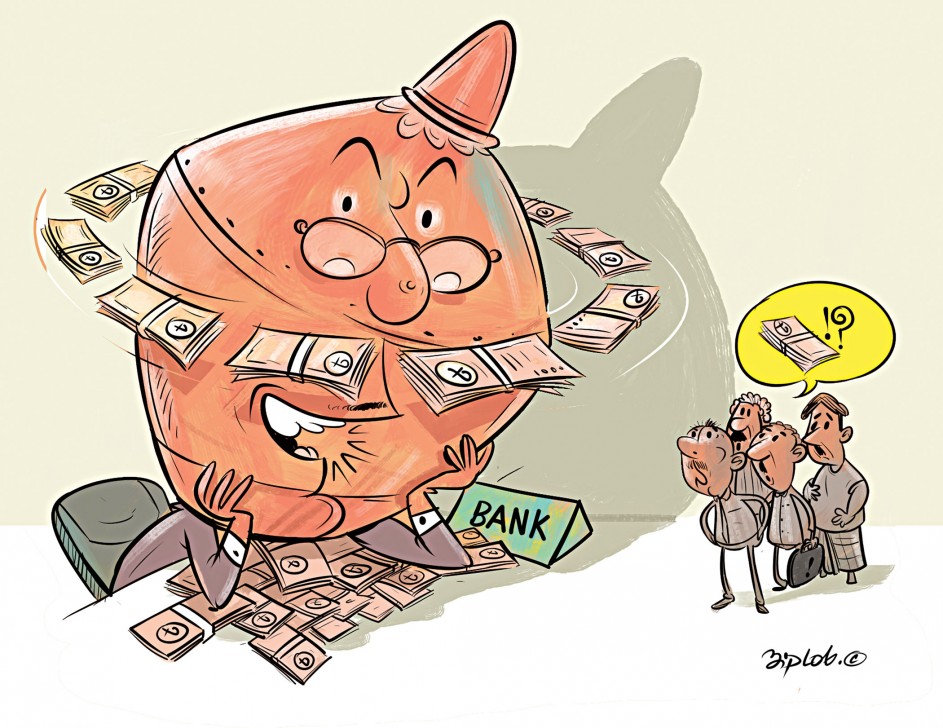

BB in a good quagmire as surplus liquidity balloons

Bangladesh Lender has fallen in a good quagmire tackling an escalation of extra liquidity trending found in banks, emerging from slow credit rating progress and implementation of stimulus plans and an upward trend in receiving remittance.

Excess liquidity found in the banking sector escalated 95 % year-on-year to Tk 204,700 crore found in December last year, which have largely been committed to treasury charges and bonds, showed info from the central bank.

There is absolutely no scope to mop up liquidity from banks currently as the surplus fund hasn't had any effect on inflation due to suppressed demand among consumers and investors as a result of economic hardship due to the coronavirus pandemic.

However the surplus liquidity has taken woes for depositors to an excellent extent as the true interest rate has recently entered into a negative territory.

Standard inflation stood at 5.52 % in November whereas most banks offered rates of interest from 3 % to 4 per cent on fixed deposit receipts (FDRs).

This means the real interest rate is in a poor 2 % to 3 %.

But on the contrary, a section of individuals have started investment their funds heavily found in the capital industry and housing zones.

Such a phenomenon may create a secured asset bubble in the days in advance, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

An asset bubble arises when the price tag on an asset, such as stocks, bonds, property, or commodities, rises at an instant pace without the fundamental fundamentals, such as for example equally fast-soaring demand, to justify the price spike.

If the asset bubble starts to grow, the central bank should think about mopping up funds from the market.

The central bank recently thought of doing so but down the road backtracked from the stance, said a number of Bangladesh Bank officials, who are directly involved with monitoring the liquidity situation available in the market.

If the central bank commenced withdrawing funds at this moment, it will certainly give a bad signal to the marketplace, they said.

The majority of clients remain shying from availing loans, which means the surplus fund was hardly playing any role in fuelling inflation.

Excess funds with the central lender also increased 323 per cent year-on-year to Tk 44,800 crore found in December last year.

The excess cash is calculated on deducting the money reserve ratio (CRR) of banks, which have to be deposited with the central bank.

The CRR may be the part of customer deposits that commercial banks must keep as a reserve with the central bank authority.

The government has up to now rolled out 23 bailout packages at differing times since March this past year to absorb the monetary shocks arising from the pandemic.

The total amount of financial assistance now stands at Tk 124,053 crore, 4.44 % of the country's GDP.

It has contributed to the growth of excess liquidity in the banking sector aswell.

Banks are actually also cautious found in sanctioning loans to debtors given the business enterprise slowdowns, contributing a accumulate of excess liquidity within their balance sheets.

Lenders will prefer the central bank's tools such as for example Bangladesh Bank bill or perhaps reverse repo, which are generally used to mop up funds from market, within an aggressive manner if the surplus fund is usually to be withdrawn.

The various tools used for mopping up cash are more secure for banks rather than through disbursement of loans to clients in instances of crisis, said the central bankers.

Mansur echoed the same, saying that enough time is yet to come quickly to mop up funds. The central bank was nowadays in a good spot in terms of tackling the excess liquidity, he said.

He warned that the excess liquidity would further widen until the economical recovery gains momentum.

"Although the government provides claimed that the market is recovering at a good faster pace, the turning up of excess liquidity has given an indication that the recovery isn't on the right track," he said.

But the major concern is: how will depositors' passions be protected from the pressure of surplus liquidity in the banking sector?

The central bank must monitor the issue very cautiously such that the ongoing business slowdown won't create another financial meltdown in the days ahead.

The central bank may intervene in the amount of money industry when the nominal interest on FDRs declines to 2 %, said Mansur, also a former official of International Monetary Fund.

The nominal interest rate is normally that before inflation is going to be taken into account.

Besides, the central lender should start withdrawing cash from the marketplace if non-food inflation takes on an upward tendency. The price of non-food is still deflated.

Three bank controlling directors, even so, opined that mopping up funds from the marketplace was not the ultimate solution as the central bank was injecting money by method of purchasing US dollars from lenders.

Lately, imports have declined while remittance continued to keep an upward trend.

It has forced the central bank to acquire the dollar from banks frequently, they said.

The central bank purchased greenback worth an archive $5.49 billion in the first half of the existing fiscal year to keep stable the exchange rate of the local currency.

The previous finest was recorded in 2013-14 when Bangladesh Bank bought $5.15 billion from local banks.

If the economic recovery does not grab at the ideal level from coming June, the government should think about doing something about the ongoing remittance inflow, explained the three MDs wishing not to be named given the sensitivity of the problem.

Mansur said remittance has already helped the forex reserve to surpass $43 billion, nonetheless it is period for the authority concerned to rethink the issue.

"The remittance, which are now being sent, isn't actual remittance. Alternatively, a large volume of remittance is moving into the region in the sort of portfolio expenditure by expatriate Bangladeshis," he said.

A portfolio expenditure is ownership of a share, bond, or other economic asset with the expectation that it'll earn a go back or grow in benefit as time passes, or both.

The majority of produced nations are in a deadlock of zero % interest rate as a result of financial meltdown and it will take them a couple of years to get back from the zero % rate.

"The expatriate Bangladeshis are actually getting a better interest on the deposits retained in the local banks than from the lenders in spots they live in," Mansur said.

Remittance hit a great all-time most of $21.74 billion last year, posting a magnificent year-on-year growth of 18.59 %.

The government may think of reducing the two 2 % cash subsidy against funds remitted by expatriate Bangladeshis, if the excess liquidity cannot be managed in time, Mansur said.

Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management, said the central bank shouldn't mop up the excess liquidity from the central bank before economic recovery benefits the full-fledged momentum.

"Both the government and the central bank should give their utmost importance to improve credit demand, that will decrease the pressure from the surplus liquidity," he said.

The year-on-year credit growth stood at 8.21 % in November, down 8.61 % from a month earlier.

The credit development in November is the lowest since 2008 at least. Bangladesh Bank's info goes dating back to 2008.

Monzur Hossain, research director of the Bangladesh Institute of Advancement Studies, said the central bank should mop up the surplus liquidity from banks right now in the fascination of depositors.

He argues that the market would face difficulties if money does not circulate properly.