Kissht launches version 2.0

India’s Fintech Consumer lending platform Kissht announced 2.0, that aims at driving credit penetration and financial inclusion by providing financial solutions that are simple, transparent and accessible to all.

Kissht introduced Scan & Pay later credit wallet early 2018 and was termed as the Fastest, Most Reliable, Secured and Convenient next-generation credit assessment model. It's new & updated version - Scan & Pay Later Version 2 will not only make credit available to all but will also add amazing features like insurance, extended warranty, instant credit limit check, credit holidays and many more add-ons for the benefit of the customer and the merchant partners in the pre-& post loan approval stage.

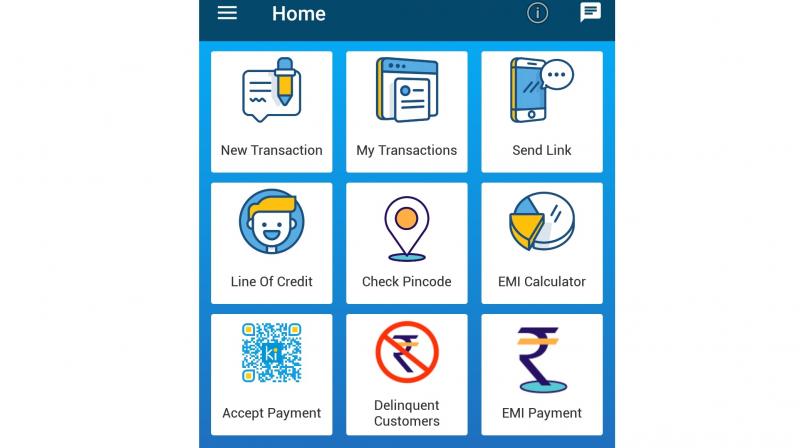

Some key features include:

Pre- Loan Approval Stage - Instant Credit Limit check within 2 secs for both Merchants & customers - This enables both the customer and the merchant to check the credit worthiness of the customer. The merchant can log into his merchant app, enter the customer details and can check the customer’s credit limit in max 2 sec. Post checking the customer limit, depending on the amount required by the customer to buy a certain product, the merchant blocks the said amount from the pre-approved limit for the product purchase over OTP and loan is final approved. The same process can be followed by the customer post logging in to the Kissht App and entering his/her credentials.

Mobile Insurance & Extended Warranty for Consumer Durables - Kissht has partnered with other prominent players with shared synergy to offer co bundled products along with mobile & consumer durables purchase. Customers can now avail mobile insurance and extended warranty on their beloved products across our 10k+ offline retail stores. For Mobile Insurance, customers enjoy protection on Accidental Damage and Liquid damage & gets advance cash for repair with PAN India coverage. In case of Extended Warranty, our partners provide Repair or Replacement Guarantee, Genuine Spare Parts Guarantee, Doorstep Service with maximum tenure of 5 years.

Individual Health & Life insurance - Kissht has joined hands with reputed Insurance companies to provide their customers with Health & Life Insurance to provide them and their families with a sense of security on availing Personal Loans across our 3k+ Kissht franchisee chains. It includes accidental, personal accident, credit line coverage for customer as well as their family basis offer selection. The process is completely digital.

Post Loan Approval Stage - Ease of EMI Payments – For Kissht, customer convenience is key. Keeping that in mind, Kissht has made various ways of EMI payments available to the customers. Customers can now pay not only via auto deduct, Kissht App, NEFT/IMPS but also through Paytm under the Loans Section. Also launched are EMIs in cash as a feature, where customer can geo locate a nearby retailer and go deposit EMIs directly. Incase of non-availability of retailer in that specific PIN code, customer can raise a request to collect EMIs from his/her home.

Instant Loan for existing customers - The Instant Loan feature has been revamped to cater to the needs of the customer enabling faster loan approval, attractive offerings, easy user interface and sophisticated backend integration for a hassle-free process.

Credit Holiday - This is a novel concept launched for Kissht’s loyal customers. This offer enables the customer to have a grace period wherein he/she can skip paying EMI for the month they are facing financial crisis and pay it in the next month or extend the tenure. This helps the customer be flexible in their payments and gives them a breather during a financial crunch.

In the past, Kissht has launched various innovative product like Instant Cash, Digital EMI Card, Scan & Pay Later, co-created lending products like Cardless Credit & Buy Now Pay Later Solution (15 days’ credit) with Flipkart & Dell under the Aarambh scheme. In Kissht 2.0, the aim is to focus on provide products that will involve all parties in the credit-ecosystem (merchants, customers, insurance companies, etc.)