Inflation overshoots focus on last fiscal year

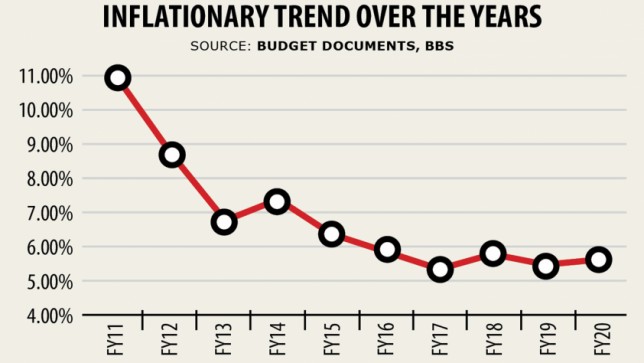

Inflation ended the just-concluded fiscal year in 5.65 %, slightly overshooting the government's target of 5.5 per cent, owing to the dragging supply chain disruption caused by the pandemic-induced shutdown.

Fiscal 2019-20's weighted-standard inflation was also 17 basis points greater than the previous year's 5.48 %, showed info from the Bureau of Statistics (BBS) yesterday.

However, it is the third lowest gross annual inflation recorded simply by the government within the last decade, spending budget papers showed. In June, total inflation rose 50 basis points to 6.02 per cent from 5.52 per cent found in the same month a year earlier, driven by the upsurge in food inflation.

Food inflation was 6.54 per cent in June, up 1.14 percentage things over the same month found in 2019.

Planning Minister MA Mannan, while releasing the info, blamed the floods and the damages due to the natural calamities for the unexpected upsurge in the general inflation.

"Once the flood condition improves, inflation would come down," he said.

Non-food inflation dropped 49 basis points to 5.22 % within the last month of the fiscal time, from 5.71 % in June this past year.

In rural areas, inflation crept up to 6.02 %, that was 5.38 % in June this past year, up 64 basis tips.

Foodstuff inflation advanced to 6.47 % from 5.58 % and non-food inflation increased by 17 basis factors to 5.18 per cent, BBS data showed.

Urban inflation was 6.03 % previous month, 25 basis items greater than in the same month a year earlier.

Foodstuff inflation rose sharply to 6.72 % from 5.01 % in June, while non-food inflation fell considerably to 5.27 per cent from 6.64 per cent.

The costs of rice, eggs, broiler chicken, fruit and vegetables such as for example potato, eggplants, lady's finger, bitter gourd, tomatoes, carrots, long coffee beans and papayas and spices such as crimson chillies, ginger and garlic rose in June from May, said the BBS in a news release.

Inflation goal for the new fiscal calendar year is 5.4 %.

The impact of monetary disruptions both on the demand and supply sides is clearly obvious in these inflationary trends, said Zahid Hussain, a former lead economist of the World Bank Dhaka office.

The supply chain remained disrupted due to the countrywide shutdown enforced to tame the raging coronavirus even though mobility restrictions were withdrawn on, may 31. Cyclone Amphan and floods didn't help. Alternatively, Ramadan accompanied by Eid in June boosted the demand for foodstuff.

"These together increased food prices."

Even so, demand for non-food items, except healthcare, remained depressed because of weak consumer confidence, cash flow losses and upsurge in unemployment.

This resulted in a reduction in non-food inflation in June relative to the previous month along with June 2019.

Increased food inflation is usually terrible current information for all population teams, but particularly for the poor and the middle-school, Hussain said.

"It really is exacerbating their financial distress. The government needs to ensure that the meals supply chains remain functional, the large operators in the low cost and retail grocery stores do not take good thing about the circumstance by engaging in selling price gouging and generate it better for newcomers to contend with existing operators in the food supply chain."

The Bangladesh Lender should strengthen inflation surveillance and keep monetary growth consistent with price stability since it finalises its monetary programme for fiscal 2019-20, he said.