India makes fifth rate cut, slashes growth forecast

INDIA’S central bank on Friday cut interest rates for the fifth time this year, putting them at a near-decade low, while it also slashed its growth forecasts as authorities struggle to kickstart Asia’s third-largest economy.

The Reserve Bank of India (RBI) said the benchmark repo rate -- the level at which it lends to commercial banks -- would be reduced by 25 basis points to 5.15 percent, the lowest since March 2010.

The RBI “decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target”, the Mumbai-headquartered bank said in a statement.

The bank also slashed its economic growth forecast for this financial year to 6.1 percent, from 6.9 percent, noting that the global economy has been losing steam owing to long-running trade uncertainty.

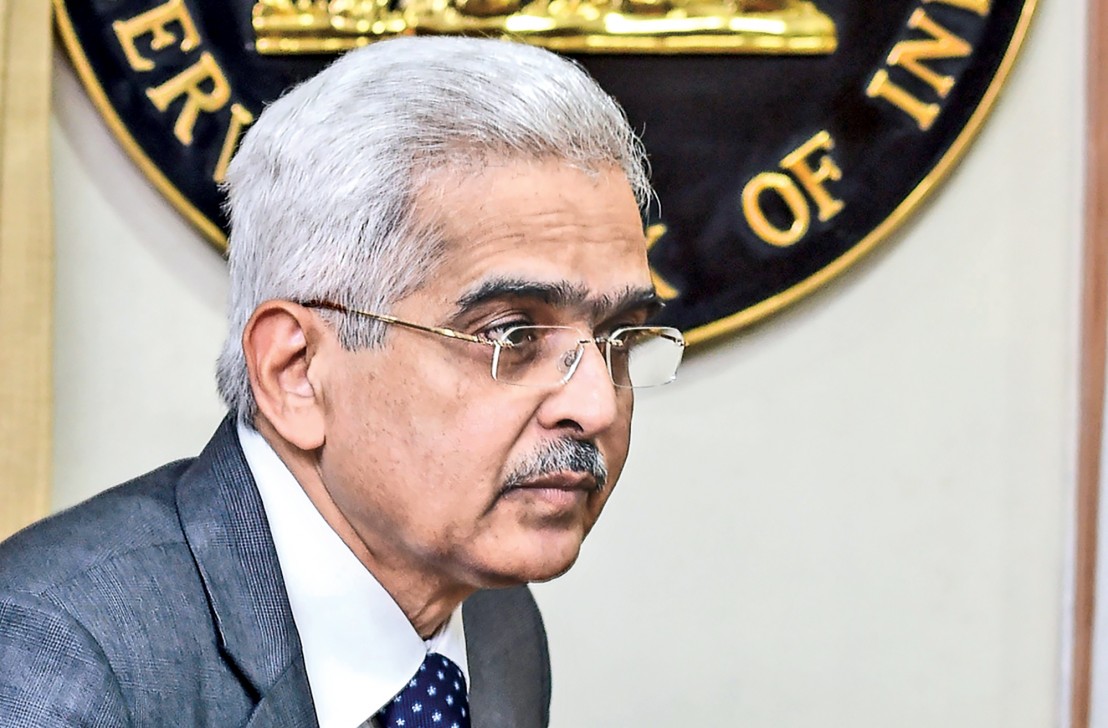

Bank governor Shaktikanta Das said: “We have cut rates by 135 basis points since February and it takes time for its impact to be transmitted to the real economy.” Analysts were divided on the potential impact of the move, with some saying the measures would do little to jumpstart the stuttering economy.

A 25 basis points cut, which was within forecasts, “will neither significantly bump up consumption nor investment”, said Ranjan Chakravarty, product strategist at Metropolitan Stock Exchange.

The bank “needs to be more aggressive to give a proper push to growth. Unfortunately this was another opportunity foregone for now”, he added.

Others said more rate cuts could be on the cards in December as officials try to ramp up rural consumption and economic activity.

“Demand in India is abysmally low and GST (goods and services tax) returns were at an 18-month-low in August, reflecting muted consumption demand,” Garima Kapoor, economist at Elara Capital, told AFP.

“RBI has room for rate cuts in the range of 15-30 basis points in December as per benign inflation dynamics”, she added.

Inflation rose to a 10-month high in August but was within the RBI’s target range of four percent.

Despite the succession of cuts, economists say banks have failed to pass on the benefits to consumers, meaning borrowing costs for loans remain high.

India has the world’s worst bad-loan ratio, prompting the government to announce a $10-billion liquidity lifeline to public-sector banks in this year’s budget.

In June, economic growth slowed for the fifth straight quarter to 5.0 percent, according to official figures.

In August, the once-booming auto sector -- seen as a crucial barometer of economic health -- reported slumping sales for the 10th-straight month, forcing companies to shut down manufacturing plants.

Desperate to ramp up investment, Finance Minister Nirmala Sitharaman last month announced corporate tax rates for domestic firms would be slashed by almost a third to 30 percent, making it one of the lowest in the region.

Experts say the tax reforms are aimed at attracting companies spooked by the China-US trade war.

Authorities have in recent weeks rolled out a series of measures to boost the economy and battle grinding unemployment, which is at its highest since the 1970s.