Foreign meat finding niche in local market

Imported cheaper frozen meat has aggressively been displacing homegrown beef in Bangladeshi eateries for the last one and a half years, which is a matter of grave concern for the local industry.

India is providing the lion’s share of the import, which picked up around the time when the influx of cattle from the neighbouring country ebbed in the face of a clampdown in the border.

In 2018-19, around 6 lakh cattle entered Bangladesh from India, down from 21 lakh in 2013-14, according to data from the National Board of Revenue.

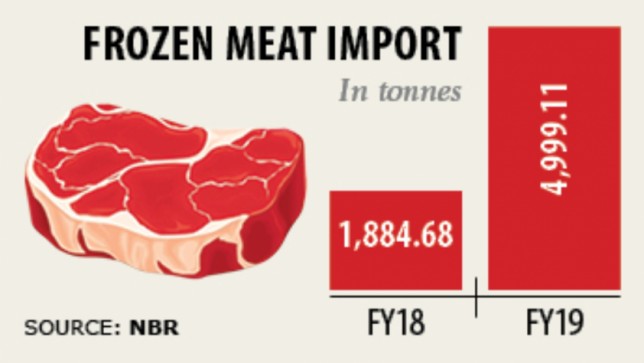

Frozen meat imports more than doubled to 4,999 tonnes in 2018-19 from a year earlier, according to customs data. And in the first two months of the fiscal year, 2,000 tonnes have already been brought in.

The main reason for the spike in imports is the price gap, said Shamim Ahamed, president of Halal Meat Importers Association of Bangladesh (HMIAB).

Because of duty benefits under the South Asian Free Trade Agreement, the total tax incidence for frozen meat imports from India is 13.75 percent, which is less than half of the duty for frozen meat imports from other countries.

After applying duty and tax, the cost of frozen meat from India stands at Tk 320 each kilogram on an average in Dhaka and offal at Tk 125 a kg -- which is much lower than the local beef’s current retail price of Tk 530-550 per kg.

The lower prices of imported meat attracted the cost-conscious restaurants and catering service providers, according to Ahamed, also the head of business operations of Igloo Foods, a concern of Abdul Monem, a leading diversified business conglomerate.

Taufiqul Islam, treasurer of Bangladesh Restaurant Owners Association, said they prefer imported boneless meat as the locally slaughtered ones cost more.

But the soaring imports is a matter of grave concern for the stakeholders of the budding sector.

Many locals started to rear cattle or expand their farming to feed the demand for red meat following the ban on cattle exports by the neighbouring country, a major meat supplier for Bangladesh.

As a result, the country attained self-sufficiency in meat production, according to the Department of Livestock Services (DLS).

At this stage, increasing meat imports would hamper the growth of the sector, said DLS, adding that nearly 2 crore people are directly and indirectly involved with the sector.

“We have always been discouraging meat imports. As we are self-sufficient in meat for our national demand, we do not think there is a need for import,” said Hiresh Ranjan Bhowmik, director general (DG) of DLS.

DLS estimates meat production was 75.14 lakh tonnes in 2018-19, which is higher than its estimate of the demand for meat for the year. The demand for meat was estimated at 72.97 lakh tonnes. “We are not in favour of imports as we want to protect our local industry.”

At the same time, there is also a risk of entry of trans-boundary disease through imported meat, Bhowmik said.

The DLS earlier requested the commerce ministry to make it mandatory for meat and meat product importers to take its no-objection certificates.

On September 12, the ministry of fisheries and livestock wrote to the commerce ministry to restrict the import of frozen and meat products from Brazil and other countries.

Bhowmik said the prices of beef and other livestock products including eggs are less than the prices of fishes.

However, Ahamed of HMIAB said beef remains inaccessible to low-income people for its high prices.

“Bangladesh is one of the lowest meat consuming countries in the world. Prices would have been corrected if there is enough supply,” he added.

The prices of locally farmed cattle and thus beef would decline by 20-25 percent if the government provides support, said Shah Emran, general secretary of the Bangladesh Dairy Farmers’ Association.

Steps should be taken to curb syndicated attempt of feed producers to increase the price of feeds.

He also demanded a cut in electricity tariff for dairy farms, low-cost loans to grow fodder and the easing of procedure to import embryo to increase cattle yield and reduce production costs.