Incentive shelling out for remittance may rise

The federal government may increase its allocation for incentive expenses for remittance in the next fiscal year since it looks to wthhold the surge of the flow of the least expensive source of foreign currency for Bangladesh.

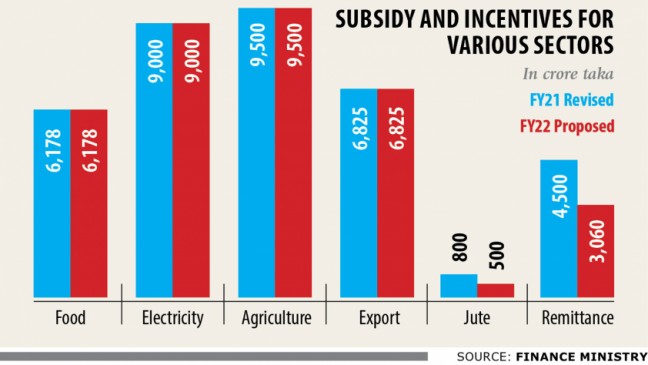

It had earmarked Tk 3,060 crore in the initial budget of the fiscal year of 2020-21 to pay out incentives to the beneficiaries of remittance. The allocation has been raised by 47.06 % to Tk 4,500 crore in the revised budget.

The government now plans to create aside Tk 4,000 crore for another fiscal year to greatly help the economy absorb the shock stemming from the coronavirus pandemic.

However, the expenditure allocation for subsidies, incentives, and cash loans will come right down to Tk 54,925 crore when compared to revised allocation of Tk 56,303 crore in FY21.

The incentive expenses for remittance are increasing as the amount of money sent by the migrant workers has been growing fast because the pandemic struck, defying grim forecasts.

The receipts went at night $20-billion mark in the first 10 months of the existing fiscal year. Between July and April, Bangladeshi received $20.66 billion, up 39 % year-on-year.

Remittance inflow surged 89 % year-on-year to $2.06 billion in April as the migrant employees transferred a whopping amount of funds before Eid-ul-Fitr.

The government has credited the two 2 per cent cash incentive and the easing of procedures for the record flow.

The World Bank says a temporary shifting from informal to formal remittance payment channels amidst the travel disruption, additional transfer to greatly help pandemic-hit families home along with the transfer of accumulative savings by the overseas workers helped surge of remittance inflow.

The finance ministry forecasts that remittance inflow may swell by 20 % in FY22.

The proposal to set the allocation at Tk 4,000 crore has been built keeping the forecast at heart, said an official of the finance ministry. "If the inflow increases, the allocation increase," he said.

The government's total subsidy spending could be set at Tk 25,800 crore, down from Tk 28,678 crore in the current fiscal.

The allocation will go to three sectors: food, electricity, and interest rate waiver on the loans extended under the stimulus packages and the purchase of liquefied gas (LNG).

The taxpayer-backed spending for the meals sector may rise to Tk 6,500 crore in FY22, from Tk 6,178 crore in FY21, as the government has a intend to continue providing food support to the poor and vulnerable people affected by the pandemic.

The subsidy for the energy sector may be set at Tk 9,000 crore, almost similar to the sum earmarked in today's fiscal year.

The government must give a significant amount of subsidy for the quick rental power plants, run mainly by diesel and furnace oil. The cost of fuels is certainly spiralling in the global markets.

The subsidy expenditure on the interest levels of the working capital loans beneath the stimulus packages and LNG import may be trimmed to Tk 10,300 crore from Tk 13,500 crore in today's fiscal year.

The incentive expenditure may total Tk 21,125 crore in FY22, up from Tk 19,825 crore allocated in the initial budget in FY21.

The sectors such as for example agriculture, export, remittance and Jute goods receive incentives through budgets.

The government may keep carefully the incentive spending for the agriculture sector unchanged at Tk 9,500 crore to keep up the growth in farm production and ensure food security.

The country's food grain production was 4.15 crore tonnes in 2019-20, and it was approximated at 4.52 crore tonnes in 2020-21.

By February, Tk 3,396 crore was spent as the incentive expenditure for the sector.

The export sector gets Tk 6,825 crore in FY22 in incentive, unchanged from FY21, as the government looks to greatly help the exporters produce a turnaround from the pandemic-induced slowdown.

Exports have been reach hard by the global crisis while the demand for goods collapsed found in the developed countries.

Shipment from Bangladesh grew 8.74 % year-on-year to $32.07 billion between July and April, data from the Export Promotion Bureau confirmed.

The finance ministry projects that export earnings would grow by 15 % in the next fiscal year, the state said.

The incentive spending for jute goods has been proposed at Tk 800 crore for FY22, like the current year's allocation.

The allocation for cash loan spending has been proposed at Tk 8,000 crore, up from Tk 6,000 crore in the revised budget.

The government provides cash credit to state-owned entities, including Bangladesh Jute Mills Corporation, Bangladesh Sugar and Foods Industries Corporation, and Bangladesh Road Transport Corporation. However the loan is seldom repaid.

The government earlier took an initiative to use money from the forex reserve for infrastructure production projects. And in its first-ever approach, it lent Tk 5,417 crore to dredge a channel for Payra port.

It is now likely to supply the money as a advance loan from the spending plan found in FY. An allocation possesses been proposed to the effect.